Tracxn has released its insights into the United Kingdom tech ecosystem for 2025, highlighting key developments across funding, sector performance, deal activity, and investor participation. The UK remained a major global technology hub during the year, ranking as the second-highest funded country worldwide, ahead of India and China, and trailing only the United States. While overall funding declined compared to previous years, the ecosystem continued to see strong late-stage activity, large funding rounds, active mergers and acquisitions, and consistent IPO and unicorn creation.

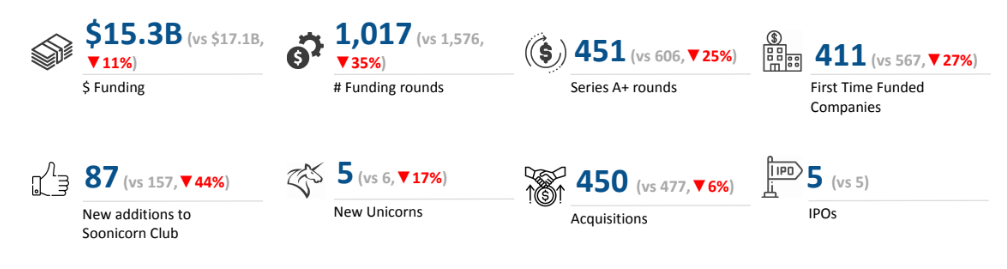

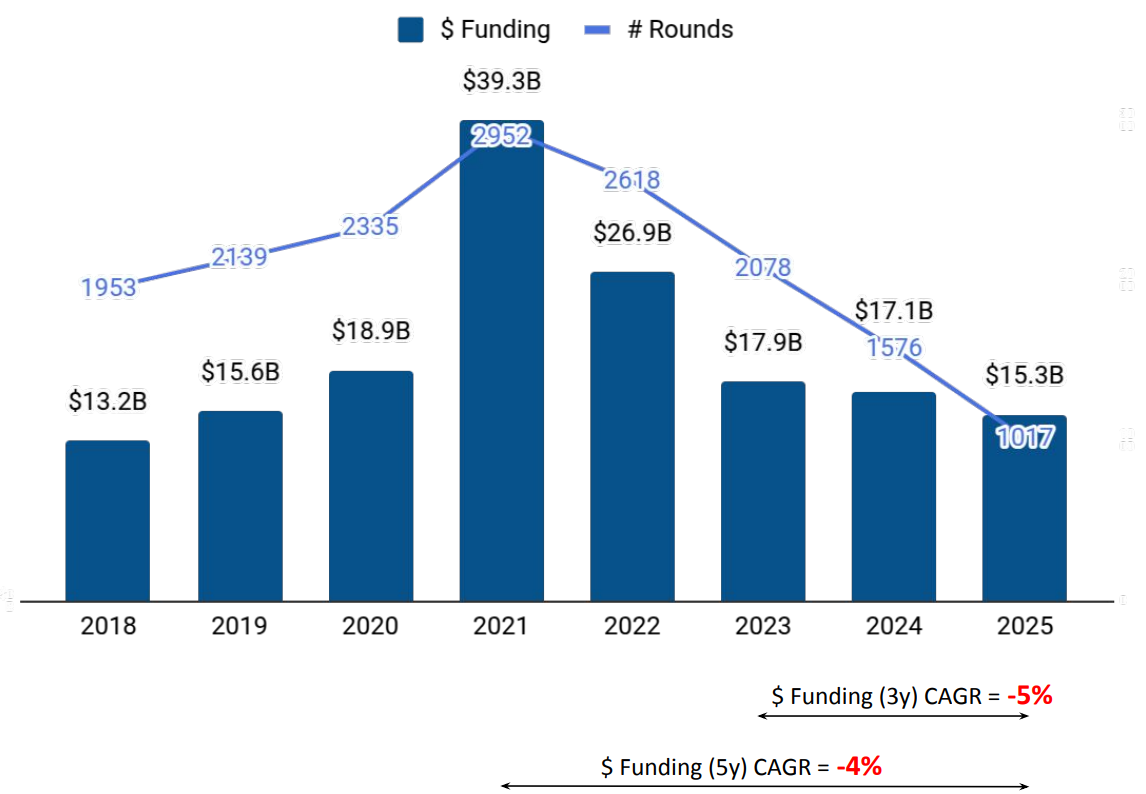

A total of $15.3B was raised by UK tech companies in 2025, representing a 11% decline compared to the $17.1B raised in 2024 and a 15% decrease from the $17.9B raised in 2023. Despite the drop in aggregate funding, the United Kingdom maintained its global standing as the second-highest funded country during the year, reflecting continued investor interest across large and mature technology companies.

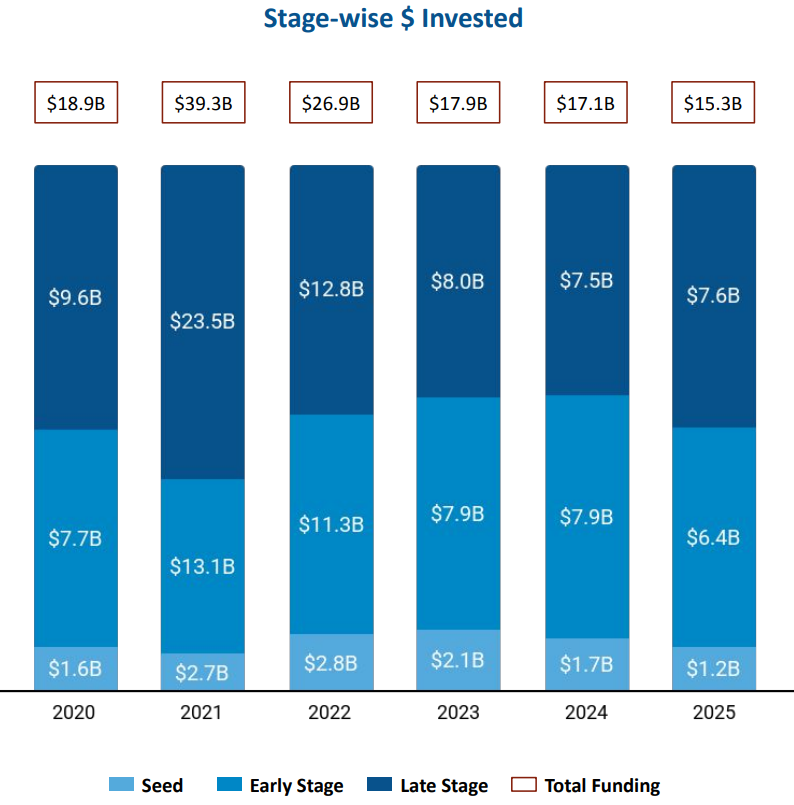

Seed-stage funding in the United Kingdom reached $1.2B in 2025, marking a 27% decrease from the $1.7B raised in 2024, and a 40% decrease from the $2.1B recorded in 2023. Early-stage funding stood at $6.4B during the year, reflecting a 19% decline compared to the $7.9B raised in 2024, while staying at the same level as 2023. Late-stage funding totaled $7.6B in 2025, representing a 1% rise over the $7.5B raised in 2024, but a 4% decrease compared to the $8B raised in 2023, with late-stage rounds continuing to account for a significant share of overall capital deployment.

Enterprise Applications, FinTech, and Life Sciences were the top-performing sectors in the UK tech ecosystem in 2025. The Enterprise Applications sector recorded $9B in total funding, reflecting a 25% increase from $7.2B in 2024 and a 27% rise from $7.1B in 2023. The FinTech sector raised $4.2B in 2025, representing a 12% decline compared to $4.8B in 2024 and a 21% decrease from $5.4B in 2023. Life Sciences companies secured $2.3B in funding during 2025, marking an 11% decline from $2.6B in 2024, while recording a 29% increase compared to the $1.8B raised in 2023.

Sports

In terms of public listings, UK tech recorded 5 IPOs in 2025, unchanged from 2024, and marking a 55% decline compared to the 11 IPOs in 2023. TeraView, Pattern Com, and Quantum Base were among the companies that went public during the year. The ecosystem also witnessed the creation of five unicorns in 2025, reflecting a 17% decline from six unicorns in 2024, and a 25% increase compared to four unicorns in 2023.

UK tech companies recorded 450 acquisitions in 2025, reflecting a 6% decline compared to 477 acquisitions in 2024, and a 4% increase from the 432 acquisitions recorded in 2023. The largest transaction of the year was the $24.3B acquisition of Worldpay by Global Payments, making it the highest valued acquisition in 2025. This was followed by the $10B acquisition of Verona Pharma by Merck.

London-based tech firms accounted for 78% of total funding raised across the United Kingdom in 2025, maintaining their dominance within the national ecosystem. Cambridge followed as the second most funded city, contributing 7% of the total funding during the year.

Investor participation remained strong across all funding stages in the UK tech ecosystem in 2025. Y Combinator, Haatch, and Fuel Ventures emerged as the top seed-stage investors during the year. At the early stage, BGF, AlbionVC, and Plural were the most active investors in UK tech companies. Late-stage funding activity was led by Durable Capital Partners, Hedosophia, and Latitude Venture Partners, which stood out as the top investors in this segment.

The United Kingdom tech ecosystem recorded $15.3B in funding in 2025, maintaining its position as the second-highest funded country globally, despite a year-on-year decline in capital raised. Strong activity in Enterprise Applications, FinTech, and Life Sciences, continued $100M+ funding rounds, five unicorn creations, and 450 acquisitions, including multi-billion-dollar deals, defined the year. While overall funding moderated compared to previous years, late-stage investments, active M&A, and consistent investor participation across stages remained central to the UK’s tech funding landscape in 2025.