Tracxn, a SaaS-based market intelligence platform, tracking 3.7M + entities worldwide, released its UK Tech Annual Report 2024. The report throws light into the UK Tech landscape, covering tech startups, funding dynamics, investor activity, exits, unicorns, and the key trends thereof.

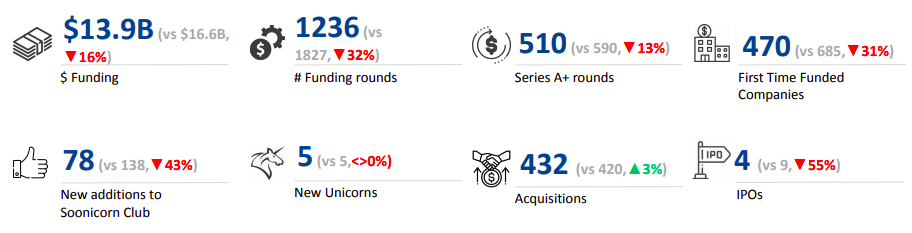

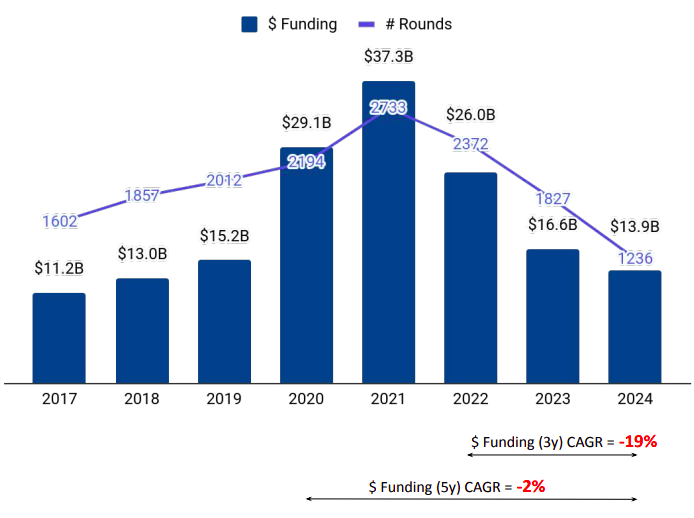

UK Tech Funding in 2024: Declining Trends with Signs of Some Stabilization in Q4 UK Tech received $13.9B funding in 2024, a 16.2% decline over $16.6B in 2023, and a 46.5% decline compared to $26B in 2022. Even the number of funding rounds showed a downtrend, declining to 1236 in 2024, a 32.2% drop compared to 1827 in 2023, and a 47.9% drop compared to 2372 in 2022.

The 32.2% decline in deal rounds in 2024, compared to a 16.2% decrease in total funding, indicates a trend where larger deals continue to take place, while smaller startups face challenges in securing investments. It further suggests a shift in investor focus toward larger-scale opportunities, potentially at the expense of early-stage companies

Q4 2024 raised $3.4B in funding, a 36.3% jump compared to $2.5B in Q3 2024, but a 24.3% drop compared to $4.4B in Q4 2023. The surge in Q4 2024 (compared to Q3 2024) indicates a potential stabilization and renewed investor confidence as the year closed.

H2 2024 raised $5.8B in funding, a 27.7% drop compared to $8.1B in H1 2024, and a 37% drop compared to $9.2B in H2 2023. Notably, despite the overall funding for 2024 being lower than that of 2023, H1 2024 achieved higher funding levels at $8.0B, surpassing the $7.3B secured during the same period in 2023 (H1 2023).

London Reigns Supreme: $8.6B in Funding Secures Its Status as the UK's Unrivaled Investment Capital

In 2024, the top 3 funded cities in UK Tech were London, with $8.6B, followed by Cambridge at $1.7B, and Oxford with $402M. Together, these cities secured 77.12% of the total investment, with London accounting for 61.87%, Cambridge contributing 12.2%, and Oxford receiving 3.0%. London’s dominance can be attributed to its status as a global financial hub, which attracts significant venture capital and fosters a vibrant startup culture.

Enterprise Applications was the Most Funded Sector with $5.8B

In 2024, the top-funded sectors in UK Tech were Enterprise Applications, followed by HighTech and FinTech. Enterprise Applications funding rose 16.3% to $5.8B in 2024 compared to $4.9B in 2023. HighTech remained stable at $5.2B in both years. FinTech funding dropped 7% to $4.8B in 2024 compared to $5.2B in 2023.

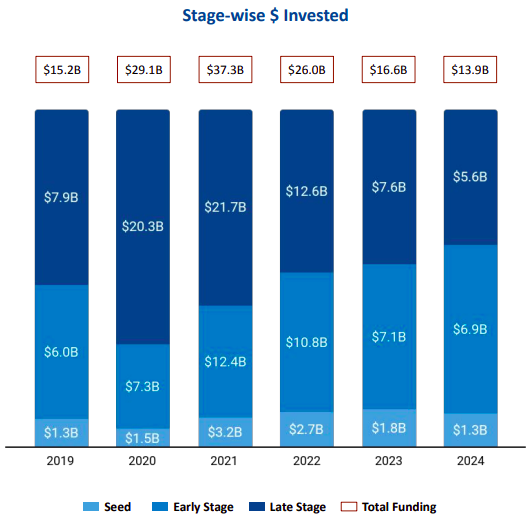

From Seed to Late Stage: UK Tech Funding Sees Double-Digit Declines Across All Stages in 2024 Seed-stage funding stood at $1.3B in 2024, a 27.7% drop when compared to $1.8B in 2023, and 51.9% drop when compared to $2.7B in 2022. Seed funding rounds hit a decadal low of 726 in 2024, when compared to 1237 in 2023, and 1564 in 20224. This indicates a significant contraction in seed-stage investment, reflecting a broader trend of investors becoming more selective and cautious. The biggest seed funding round was $80M secured by Stability AI, an AI-Focussed firm.

Early-stage funding stood at $6.9B in 2024, a 2.9% decline compared to $7.1B in 2023, and a 36.1% decline compared to $10.8B in 2022. In 2024, the biggest Early-Stage funding round was a $1.0B Series B round secured by Abound, a FinTech firm. In 2023, the biggest Early-Stage funding round was a $623M Series A round secured by Conigital. This indicates that while overall Early-Stage funding has seen a decline, the ticket size for the biggest funding round has gone up in 2024.

Late-stage funding (including PE & Pre-IPO rounds) stood at $5.6B in 2024, a 26.3% decline compared to $7.6B in 2023, and a 55.6% decline compared to $12.6B in 2022. The biggest Late-Stage funding round was a $1.1B Series C round secured by Wayve, a AI-Focussed firm on autonomous driving. Next in sequence was $430M Series I funding secured by Monzo, a FinTech firm. This highlights that while overall late-stage funding may be down, specific companies continue to attract substantial investment due to their innovative solutions and market potential.

First Time Funded Startups Reduced to 470

In 2024, the number of First Time Funded Startups stood at 470, a 31.4% decline compared to 685 in 2023. This is in-line with the broader trend that reflects a tightening investment climate, which likely contributed to fewer first-time funded startups.

Fuel Ventures and BGF Lead Emerge as Most Active VCs in Seed and Early-Stage Deals, Respectively

In 2024, Fuel Ventures emerged as the most active venture capital firm at the seed stage, completing 11 investment rounds, followed closely by Ascension with 10 rounds. At the early stage, BGF led the way with 10 investments, while Octopus Ventures secured the second position with 9 rounds. Meanwhile, late-stage funding saw participation from a few venture capital firms, each making a single investment.

Five Unicorns Emerge in 2024, Matching 2023 Milestone

In 2024, five new unicorn startups emerged, equaling the number established in 2023. These include Lighthouse, Moniepoint, Flo, Wayve, and Mews. Notably, the fourth quarter saw the highest activity, with two new Unicorns.

IPO Activity Dips in 2024, While Acquisitions Remain Stable

In 2024, the number of IPOs nearly halved to 4 compared to 9 in 2023. The companies that went public in 2024 were HighRoller, Marex, Diasoft, and Perfect Moment.

The number of acquisitions jumped by 2.6% to 432 in 2024 compared to 420 in 2023. The highest-valued acquisition in 2024 was Darktrace, acquired by Thoma Bravo at a price of $5.3B, followed by the acquisition of Preqin by BlackRock at a price of $3.2B.

Future Outlook:

Key events that will shape UK Tech funding activity in 2025 include Migration Advisory Committee (MAC) review of immigration within the IT and engineering sectors, the impact of the Financial Conduct Authority’s (FCA) five-year plan leading up to 2030, Rate cuts by Bank of England, and the initiative aimed at transitioning to zero-emission vehicles.

Migration Advisory Committee (MAC) review of immigration in Tech sectors: Depending on the MAC’s findings, there may be reforms in immigration policies affecting the tech sector, which could have both positive and negative implications for funding and investment. The review's outcomes could align with broader government initiatives to strengthen the domestic workforce. While this may enhance long-term sustainability, it could also introduce short-term challenges for tech companies reliant on international talent

Impact of Financial Conduct Authority’s (FCA’s) five-year five-year plan:

The FCA's five-year strategy aims to enhance regulatory efficiency, tackle financial crime, and foster economic growth, creating a more transparent, stable, and attractive environment for investors. This could boost investor confidence and lead to greater capital inflows, while encouraging innovation and new funding opportunities. However, stricter regulations may raise compliance costs for some, impacting access to funding for smaller firms.

Rate cut by Bank of England (BoE):

It is anticipated that BoE will implement interest rate cuts in 2025. Lower interest rates generally reduce the cost of borrowing, making leveraged deals more financially viable for private equity firms. For venture capital firms, reduced rates can enhance liquidity in the market, as institutional investors may allocate more capital to higher-yielding alternatives like startups and growth-stage companies. Consequently, the interplay between interest rates, access to capital, and return expectations will be key determinants of how PE and VC firms navigate funding decisions and investment opportunities in the coming year.

Transition to Zero-Emission-Vehicles

In December 2024, the UK government launched a consultation to restore the 2030 phase-out date for new petrol and diesel cars, reversing the previous extension to 2035. This initiative aims to accelerate the transition to zero-emission vehicles, aligning with commitments from manufacturers like Nissan and Stellantis, who have pledged to fully transition to electric cars by 2030. The consultation seeks industry input on implementing the Zero Emission Vehicle (ZEV) mandate, which outlines the required percentage of new zero-emission cars and vans to be sold each year up to 2030. The government emphasizes that this move will provide clarity and confidence for long-term investments in the UK's automotive sector, supporting economic growth and the shift to clean energy.