Tracxn has released its UK Tech 9M 2025 Report, capturing funding and investment activity across the United Kingdom’s technology ecosystem for the first nine months of 2025. The country ranked as the second highest-funded market globally, behind only the United States, with India and Germany following in the third and fourth positions respectively. The period reflected steady funding momentum, marked by billion-dollar rounds, notable sector surges, acquisitions, and IPO activity.

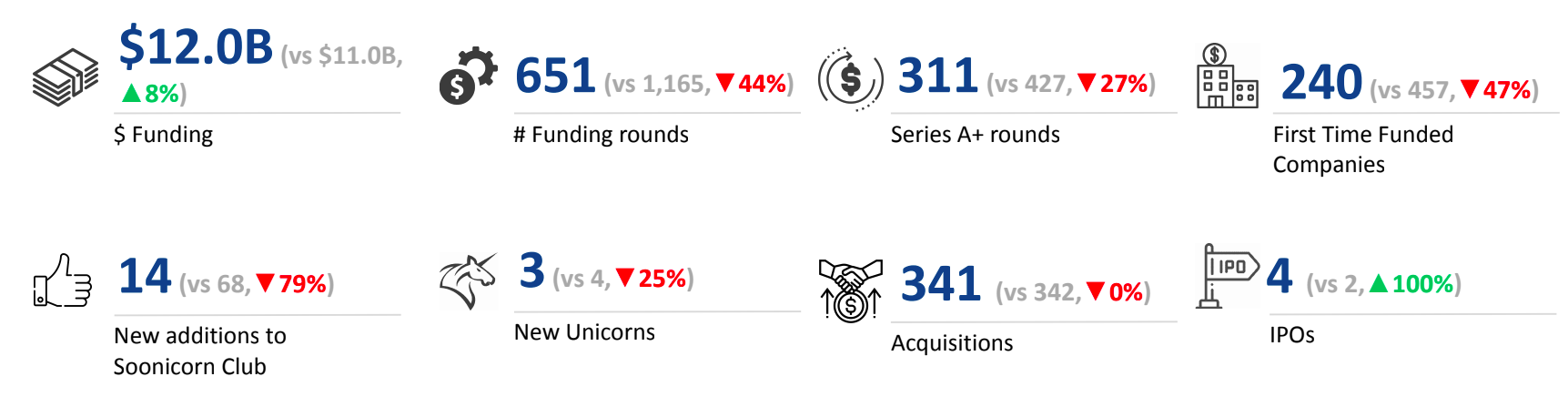

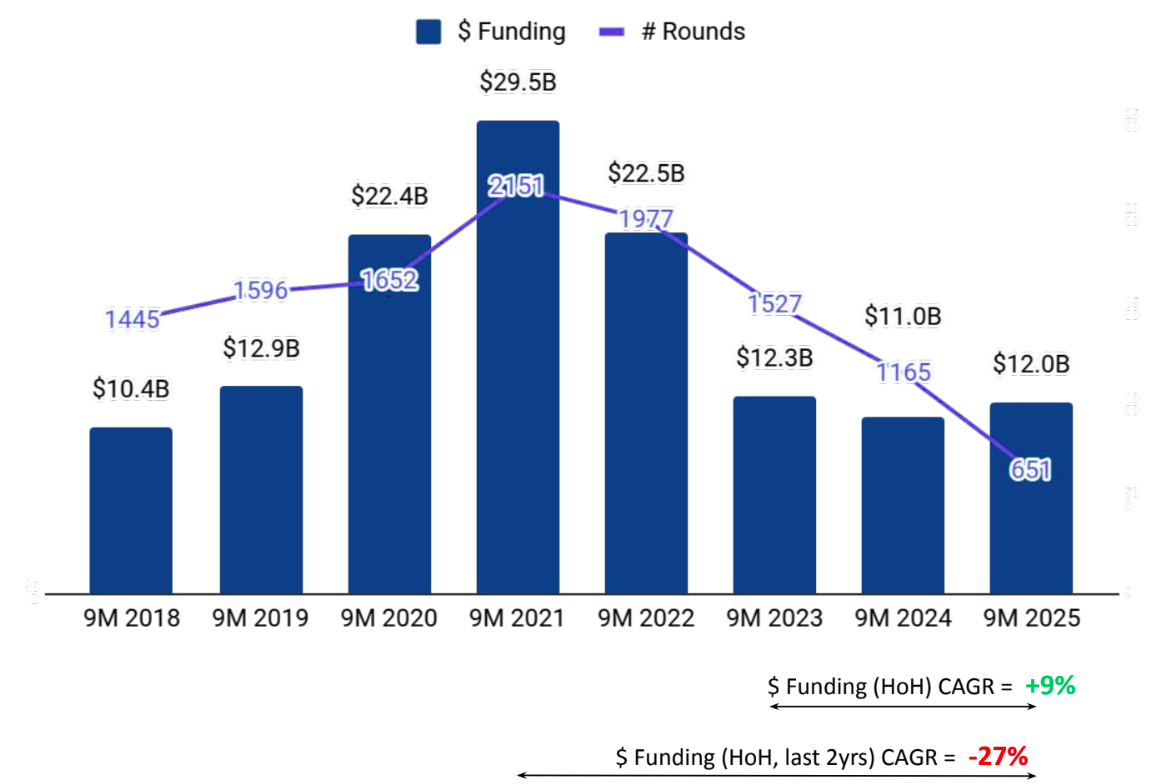

UK tech companies collectively raised $12.0B in 9M 2025, reflecting a healthy 8% increase from the $11.0B recorded in 9M 2024. While slightly below the $12.3B achieved in 9M 2023, the sector has continued to demonstrate resilience and its ability to attract strong investor interest, cementing the United Kingdom’s position as one of the world’s top-funded tech ecosystems.

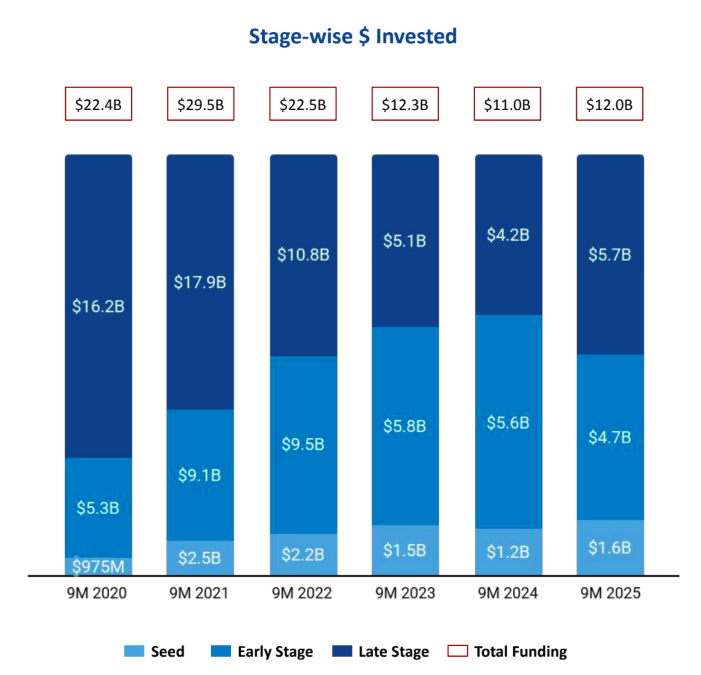

Seed-stage funding in the United Kingdom amounted to $1.6B in 9M 2025, marking a 31% rise from $1.2B in 9M 2024 and an 8% rise compared to $1.5B in 9M 2023. Early-stage investments totaled $4.7B, down 15% from $5.6B raised in 9M 2024 and down 18% from $5.8B in 9M 2023. Late-stage funding reached $5.7B, reflecting a 36% increase from $4.2B in 9M 2024 and an 11% increase from $5.1B in 9M 2023.

Enterprise Applications, FinTech, and Media & Entertainment emerged as the top-performing sectors in 9M 2025. Enterprise Applications secured $6.6B, a 39% increase compared to $4.8B in 9M 2024 and a 34% increase compared to $5.0B in 9M 2023. The FinTech sector attracted $3.0B, reflecting a 21% decrease from $3.8B in 9M 2024 and a 19% decrease from $3.7B in 9M 2023. Media & Entertainment experienced the sharpest surge, raising $1.9B in 9M 2025, which is an increase of over 1000% compared to $159M in 9M 2024 and over 1200% compared to $138M in 9M 2023.

The United Kingdom witnessed 20 funding rounds of $100M+ in 9M 2025, compared to 21 such rounds in 9M 2024 and 16 in 9M 2023. Notable large rounds included Nscale raising $1.1B in a Series B round, DAZN securing $1.8B across two separate rounds of $1B and $827M in Series D and Angel rounds respectively, and Isomorphic Labs raising $600M in a Series D round. A major portion of these $100M+ rounds came from Enterprise Applications, FinTech, and Media & Entertainment sectors.

There were 3 unicorns created in 9M 2025, a decline of 25% compared to 4 in 9M 2024, but a rise of 50% compared to 2 in 9M 2023. The UK Tech ecosystem also recorded 4 IPOs in 9M 2025, an increase of 100% from 2 IPOs in 9M 2024, though a 64% decline from 11 IPOs in 9M 2023. The companies that went public during the period were Pattern Com, Quantum Base, RedCloud, and Diginex.

A total of 341 acquisitions were recorded in UK Tech during 9M 2025, nearly matching the 342 seen in 9M 2024 and marking a 4% increase compared to the 328 acquisitions in 9M 2023. This consistency highlights the continued strength of the UK’s M&A activity, with leading global players showing confidence in the ecosystem. The standout transaction of the period was Global Payments’ landmark $24.3B acquisition of Worldpay, making it the largest deal of 9M 2025. This was followed by Merck’s $10B acquisition of Verona Pharma, further underscoring the global appeal of UK-based companies.

London-based tech firms accounted for 83% of all funding raised in the United Kingdom during 9M 2025, establishing its dominance as the country’s primary hub for venture activity. Cambridge ranked next, contributing 5% of the total funding.

Y Combinator, Fuel Ventures, and Haatch were the most active seed-stage investors in the UK Tech ecosystem in 9M 2025. In early-stage funding, AlbionVC, Notion, and BGF emerged as the top investors. Latitude Venture Partners, Durable Capital Partners, and BeyondNetZero led in late-stage investments.

The UK Tech ecosystem recorded $12.0B in funding in 9M 2025, rising from last year but trailing 2023 levels. Seed-stage investments increased, while early-stage funding contracted and late-stage capital surged significantly. Enterprise Applications, FinTech, and Media & Entertainment dominated sectoral funding, with Media & Entertainment showing an unprecedented jump. The country saw major deals above $100M, new unicorns, and IPO activity, while acquisitions remained robust with multibillion-dollar transactions. London continued to drive the majority of funding activity, supported by strong participation from leading global and domestic investors.