Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Quarterly Report: UK Tech Q1 2024. The report, based on Tracxn’s extensive database, provides insights into the UK Tech space.

The United Kingdom is currently the sixth largest economy globally and the UK Tech startup ecosystem ranks third in terms of funding raised in the first quarter of 2024, after the US and China.

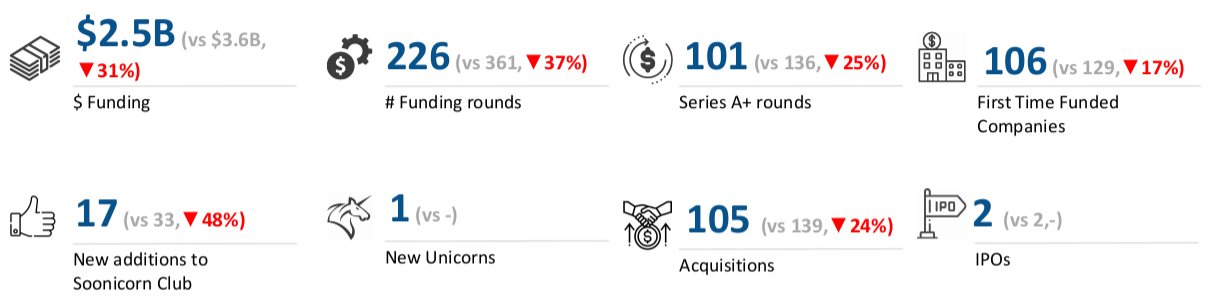

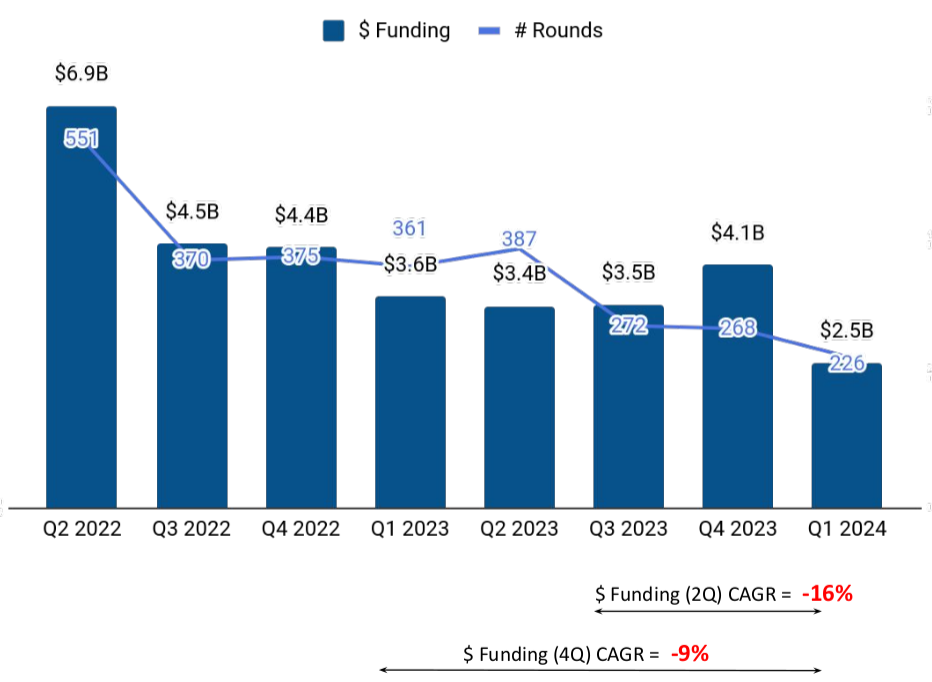

The UK Tech startup ecosystem raised a total of $2.5 billion in Q1 2024 to date (till March 15, 2024), which is 19%, lower than the $3.09 billion raised in the same period in Q4 2023 (till December 15, 2023), and a drop of 18% compared with $3.06 billion raised in the same period in Q1 2023 (till March 15, 2023).

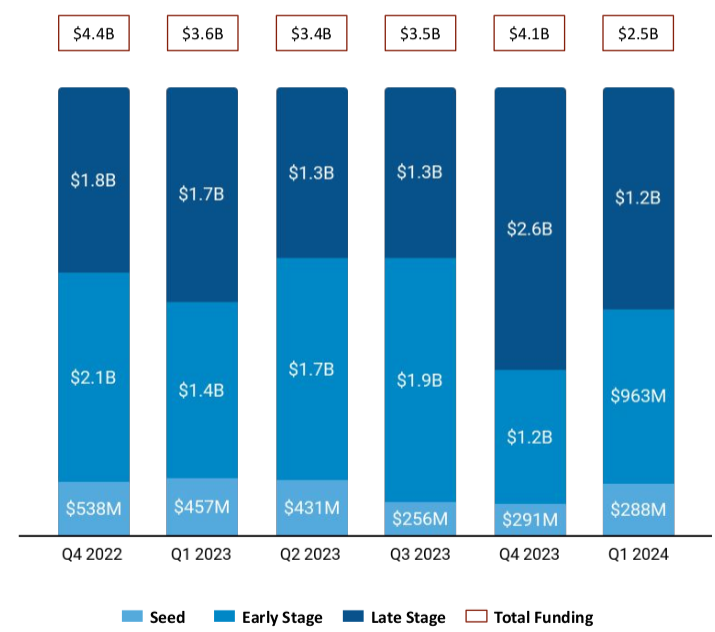

Late-stage investments were the most affected in the first quarter of 2024. Companies in this space secured late-stage funding worth $1.2 billion in Q1 2024 to date, a decline of 33% compared with the $1.8 billion raised in Q4 2023 and an 8% decrease from the $1.3 billion raised in the same period in Q1 2023. Early-stage funding stood at $963 million in Q1 2024, a drop of 7% compared with $1 billion raised in Q4 2023 and a fall of 24% from $1.3 billion raised in the same period last year.

Seed-stage investments grew 12% to $288 million in Q1 2024 to date from $259 million raised in the same period in Q4 2023. However, it is a drop of 27% compared to $398 million raised in the same period in Q1 2023.

In Q1 2024, only four companies reported $100M+ funding rounds - Monzo, Flagstone, Mews, and Build a Rocket Boy. Mews became the only new Unicorn to emerge during the quarter, after raising $110 million in a Series D round that valued the company at $1.2 billion.

FinTech, Enterprise Applications, and Life Sciences were the top-performing segments in the UK Tech sector, based on funding in Q1 2024 to date in the UK tech ecosystem. The FinTech sector secured a total funding of $1 billion in Q1 2024 to date, a drop of 8% compared with $1.18 billion raised in the same period in Q4 2023, and a 12% decrease from $1.24 billion raised in the same period in Q1 2023. Companies in the Enterprise Applications space saw a sharp surge of 90% in funding, to $950 million in Q1 2024 to date, from the $500 million raised in the same period in Q4 2023.

A slight improvement was observed in terms of exits. A total of 105 acquisitions were observed in Q1 2024 to date, as against 91 in the same period in Q4 2023. Further, only two companies - AWAKN and Perfect Moment - have gone public in the first quarter of 2024 so far, an uptick from Q4 2023 when no IPOs took place.

London continues to dominate the funding landscape. Startups based in the UK’s capital city raised $1.7 billion to date in Q1 2024, followed by those based in Edinburgh and Cambridge, which raised $130 million and $108 million, respectively.

Techstars, Mercia, and Scottish Enterprise are the overall all-time most active investors in the UK Tech sector to date. Episode 1 Ventures, Hoxton Ventures, and Northstar Ventures were the top seed-stage investors in Q1 2024 to date, while Notion, Octopus Ventures, and Taiwania Capital were the most active early-stage investors. CapitalG, Sprints, and Alignment Growth were the top investors in late-stage rounds in Q1 2024 to date.

&zN8wj;

Q3 2020 was the highest funded quarter in the UK Tech startup ecosystem, followed by Q1 2022 after which, the funding has been on a downward trend. Despite the challenges, the UK continues to be one of the largest tech startup ecosystems in the world. The UK government plans to invest £1.5 million in a marketing initiative to boost the country's science and technology sector. Various other initiatives taken by the UK government are also expected to give a boost to the industry’s growth.