Tracxn has released its Q1 2025 United Kingdom Tech Funding Report, revealing that the country ranked as the 2nd highest funded globally in the quarter, behind the United States and ahead of India and Germany.

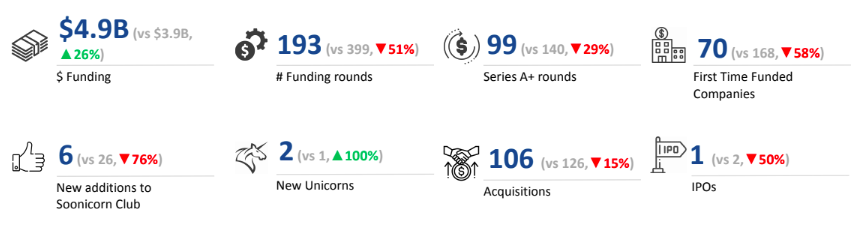

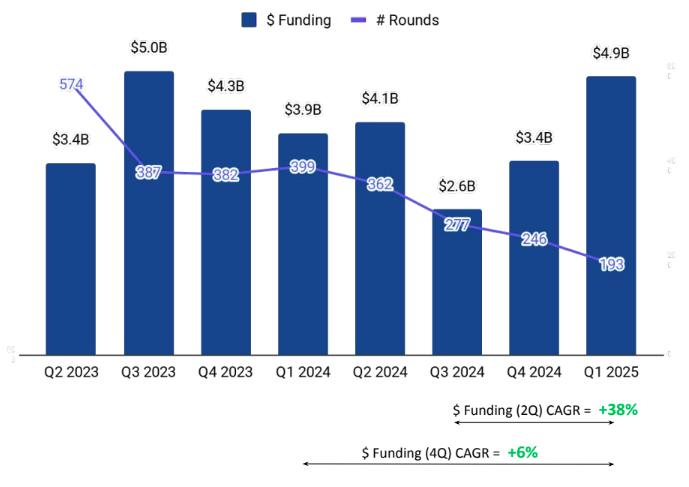

A total of $4.9B was raised in Q1 2025 in the United Kingdom, marking a significant increase of 44% compared to the $3.4B raised in Q4 2024, and an increase of 26% compared to the $3.9B raised in Q1 2024. This growth underscores renewed investor interest and momentum across the UK's tech ecosystem.

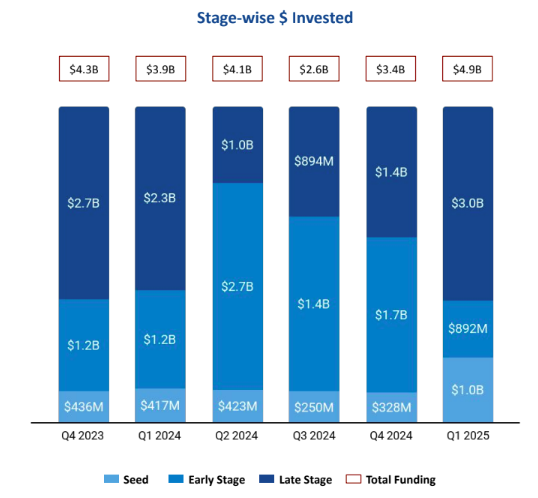

Seed Stage saw a total funding of $1B in Q1 2025, an increase of 205% compared to $328M raised in Q4 2024, and an increase of 140% compared to $417M raised in Q1 2024. Early Stage witnessed a total funding of $892M in Q1 2025, reflecting a decline of 48% compared to $1.7B raised in Q4 2024, and a drop of 26% compared to $1.2B raised in Q1 2024. Late Stage investments amounted to $3B in Q1 2025, an increase of 114% from the $1.4B raised in Q4 2024, and an increase of 30% compared to $2.3B raised in Q1 2024.

Enterprise Applications, Media & Entertainment, and Life Sciences were the top-performing sectors in Q1 2025. Enterprise Applications sector saw a total funding of $2.1B in Q1 2025, which is an increase of 41% when compared to $1.5B raised in Q4 2024 and a drop of 5% when compared to $2.2B raised in Q1 2024. Media & Entertainment sector funding reached $1.8B in Q1 2025, reflecting a significant rise of 7218% from $25M in Q4 2024 and 5249% from $34.2M in Q1 2024. This growth was driven by DAZN that raised a total of $1.8B in 2 funding rounds.

Life Sciences saw a total funding of $785.4M in Q1 2025, which is a drop of 13% when compared to $901.1M in Q4 2024 and an increase of 87% when compared to $420.4M raised in Q1 2024.

In Q1 2025, the United Kingdom saw 8 $100M+ funding rounds, when compared to 6 such rounds in Q4 2024 and 5 in Q1 2024. Companies like DAZN, Isomorphic Labs, Peregrine, Synthesia, and Ori have managed to raise funds above $100M in this quarter. DAZN has raised a total of $1.8B in this quarter across Series D and Angel rounds. Isomorphic Labs has raised a total of $600M in a Series D round led by Thrive Capital. Peregrine has raised a total of $190M in a Series C round led by Sequoia Capital. A major part of these $100M+ funding rounds are from Media & Entertainment, Enterprise Applications and HealthTech.

RedCloud was the only company to go public in Q1 2025. There were 2 unicorns created in Q1 2025, compared to 1 unicorn in Q1 2024.

In Q1 2025, the United Kingdom saw 106 acquisitions when compared to 111 acquisitions in Q4 2024 and 126 in Q1 2024. Kantar Media was acquired by H.I.G. Capital at a price of $1.0B. This became the highest valued acquisition in Q1 2025, followed by the acquisition of Chimerix by Jazz Pharmaceuticals at a price of $935M.

London-based tech firms accounted for 83% of all tech funding, with Cambridge trailing in second place.

Fuel Ventures, BGF, and SFC Capital emerged as the top investors in the United Kingdom tech ecosystem in Q1 2025. Fuel Ventures, SFC Capital, and Cambridge Innovation Capital were the top seed-stage investors. QED Investors, Acurio Ventures, and DN Capital led early-stage funding, while Lauxera Capital Partners, O.G. Venture Partners, and RPS Ventures dominated late-stage investments.

The UK tech ecosystem demonstrated strong growth in Q1 2025, emerging as the second highest funded country globally. A sharp rise in late-stage funding and a resurgence in seed investments drove overall momentum, despite a decline in early-stage activity. Enterprise Applications, Media & Entertainment, and Life Sciences attracted the most capital, reflecting continued investor confidence in scalable and innovation-led sectors.