Tracxn's research desk publishes quarterly analysis of the broad funding trends in startups and tech companies across the globe. The following are the key findings from the UK Tech report for July-August-September 2024.

The United Kingdom is the third highest-funded country in Q3 2024 ahead of Germany and China at positions 4 and 5. The only two countries that saw more funding than the United Kingdom are the United States and India.

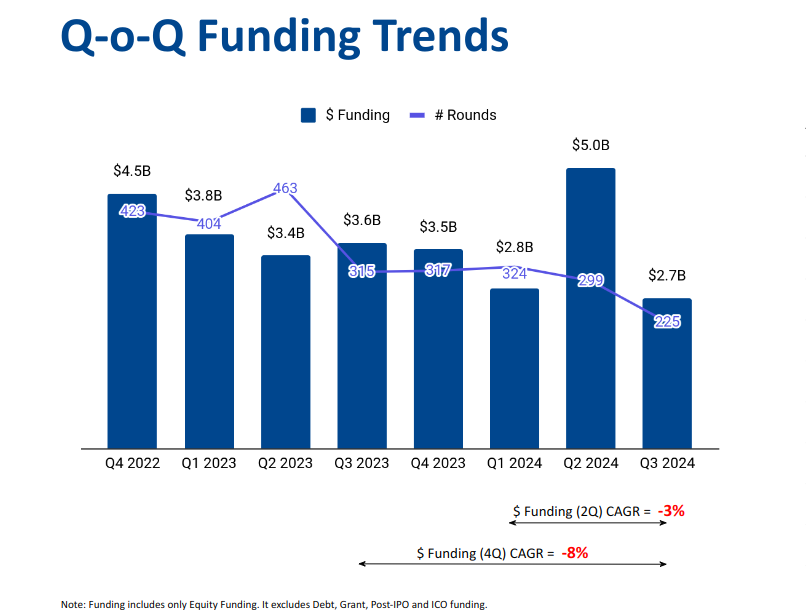

This is despite an overall funding decline across all stages of investing - seed, early, and late. The period witnessed eight 100M+ funding rounds, with companies like Flo, CloudPay, Myricx Bio, Yodel, and F2g raising funds above $100 million. Overall, the UK tech startup ecosystem saw a total of $2.66 billion being raised in Q3 2024, a drop of 46.44% compared with $4.97 billion raised in Q2 2024, and a drop of 27% compared to $3.65 billion raised in Q3 2023.

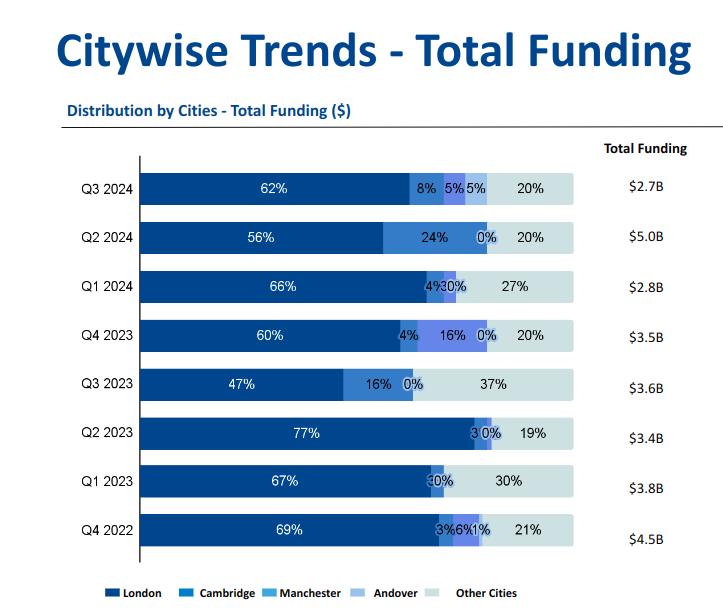

Tech companies based out of London captured 62% of all VC & PE funding seen in the UK Tech space. This was followed by Cambridge at a distant second at 8%. This is a remarkable shift from the previous quarter where startups and tech companies based out of Cambridge had secured 24% of the overall funding. When we look at the broader long-term trends, it is interesting to note that startups from four cities, London, Cambridge, Andover, and Manchester, consistently account for 70-80% of all funding across the UK Tech landscape.

Among VCs, UK-based SFC Capital, Ascension, and Concept Ventures took the lead in seed-stage rounds, adding three companies each to their portfolios. Another UK-based fund BGF added five new companies to its early-stage portfolio. Late-stage VC investments saw Singapore-based EDBI and UK-based Vitruvian Partners and Planet First Partners add one company each to their portfolios. Investors based in the UK led most of the investments at all stages.

Among the “Unicorns” (companies valued at $1 Billion or more, and often sought after by VCs), the UK saw the emergence of one new Unicorn - “Flo”, a 2016-founded, London-based startup which provides an AI-based mobile app that tracks and predicts menstrual cycles. Globally, the same period saw 20 startups joining the Unicorn Club.

Women Health Management was the business model with the most funding, driven by Flo's $200 million Unicorn round. This was followed by Oncology Drugs ( $165 million across 6 rounds ) and Payroll Management Solutions ( $135 million across 3 rounds).

There were at least 104 acquisitions in the UK Tech space in Q3 2024, with the most notable deal being the acquisition of LandVault, a Web3.0 Investment Tech company, by US-based Infinite Reality for $450 million. Other notable deals include Fusebox Games being acquired by India-based Nazara for $34.3 million and Watford-based “obconnect” being acquired by UK-based PayPoint for $13.5 million.

While funding trends signal a cooling in some sectors, notable events indicate growth in others.

The UK startup landscape in Q3 2024 has been shaped by significant declines in funding across all stages and notable acquisitions. Key sectors such as High Tech, Enterprise Applications, and Life Sciences have seen varying levels of growth and decline.

Conclusion:

In Q3 2024, UK startups maintained their competitive edge on the global stage despite facing significant funding declines. With London still leading in funding share, growth continues to be driven by innovative sectors such as Women's Health. Investors remain active, indicating that the UK startup ecosystem is poised for resilience and future expansion.

Notes:

Data for Q3 2024 has been taken from July 1, 2024 - Sep 30, 2024.