Tracxn has released its detailed insights on the US FinTech ecosystem for 2025, providing a comprehensive overview of funding activity, deal flow, IPOs, acquisitions, and investor participation throughout the year. The data illustrates how capital deployment evolved across funding stages, highlights an increase in large-ticket funding rounds, and captures elevated activity in the public markets. The insights also reflect continued concentration of funding in major technology hubs across the United States, alongside developments in unicorn creation and acquisition activity that shed light on consolidation trends and high-value transactions. In addition, the report outlines the role of leading investors across seed, early, and late stages, highlighting patterns of participation across the US FinTech funding landscape.

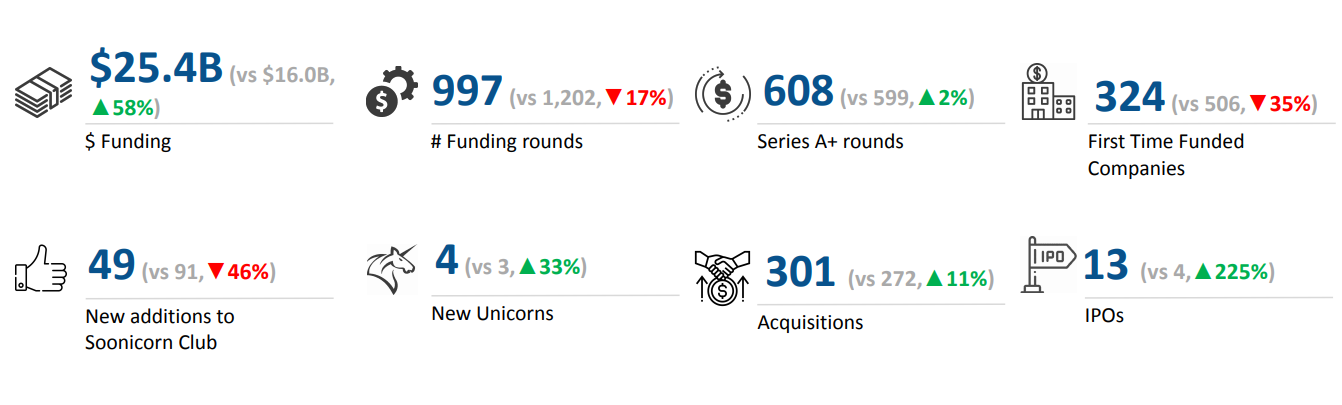

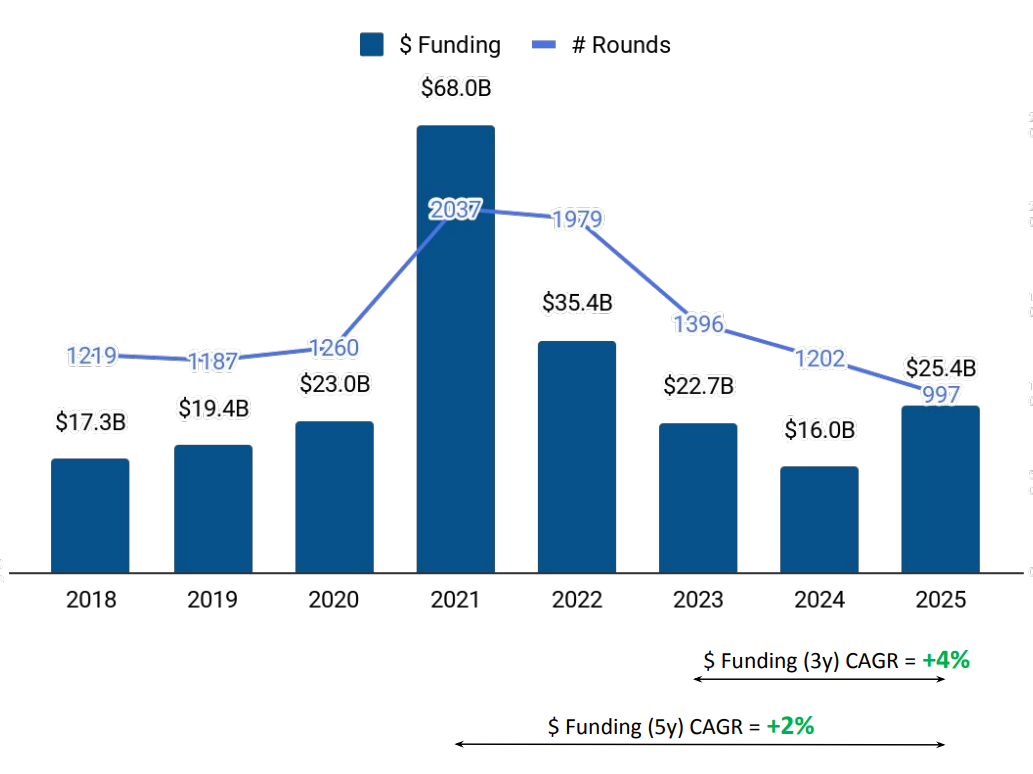

A total of $25.4B was raised by US FinTech companies in 2025, representing a rise of 58% compared to the $16.0B raised in 2024 and a rise of 12% compared to the $22.7B raised in 2023. The overall increase in funding reflects higher capital deployment across the ecosystem, supported by a greater number of large funding rounds during the year.

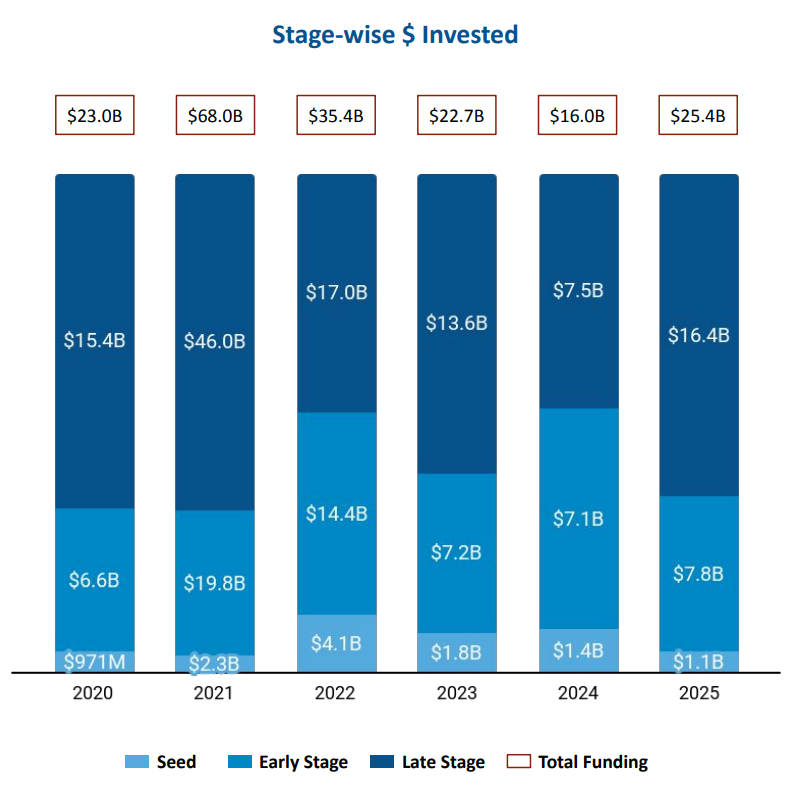

Seed-stage funding stood at $1.1B in 2025, marking a drop of 20% compared to $1.4B raised in 2024 and a drop of 40% compared to $1.8B raised in 2023. Early-stage funding reached $7.8B in 2025, rising 10% from $7.1B in 2024 and increasing 8% compared to $7.2B raised in 2023. Late-stage funding accounted for the largest share, with $16.4B raised in 2025, a rise of 118% compared to $7.5B raised in 2024 and a rise of 21% compared to $13.6B raised in 2023.

The US FinTech ecosystem witnessed 50 funding rounds of $100M or more in 2025, compared to 34 such rounds in 2024 and 31 in 2023. Companies such as Acrisure, Kalshi, and iCapital raised funding rounds exceeding $100M during the year. Acrisure raised a total of $2.1B through a Series D round, Kalshi raised a total of $1B through a Series E round, and iCapital raised a total of $820M through a Series E round.

US FinTech recorded 13 IPOs in 2025, up 225% from four IPOs in 2024 and up 63% from eight IPOs in 2023. Wealthfront, Exzeo, and Navan were among the companies that went public during the year. There were four unicorns created in 2025, a rise of 33% compared to three in 2024 and a drop of 20% compared to five in 2023.

FinTech companies in the United States saw 301 acquisitions in 2025, reflecting a rise of 11% compared to 272 acquisitions in 2024 and a rise of 45% compared to 207 acquisitions in 2023. Mr. Cooper was acquired by RocketCompanies at a price of $14.2B, making it the highest-valued acquisition of 2025. This was followed by the acquisition of Core Scientific by CoreWeave at a price of $9B.

Funding activity in 2025 remained highly concentrated geographically. New York City–based tech firms accounted for 27% of all funding raised by US FinTech companies during the year, followed by San Francisco, which contributed 20% of the total funding raised.

Investor participation varied across funding stages in the US FinTech ecosystem in 2025. Y Combinator, General Catalyst, and BrokerTech Ventures were the top seed-stage investors during the year. At the early stage, Accel, QED Investors, and Commerce Ventures emerged as the most active investors. In late-stage funding, Hedosophia, Geodesic Capital, and Sapphire Ventures led investment activity across the ecosystem.

The US FinTech ecosystem recorded strong funding activity in 2025, with total capital raised reaching $25.4B and a significant rise in late-stage investments. While seed-stage funding declined, early-stage funding grew, and late-stage funding more than doubled compared to the previous year. The ecosystem also saw an increase in $100M+ funding rounds, higher IPO activity, and a rise in acquisitions, led by large-scale transactions. New York City and San Francisco remained the leading funding hubs, and investor participation was active across all funding stages.