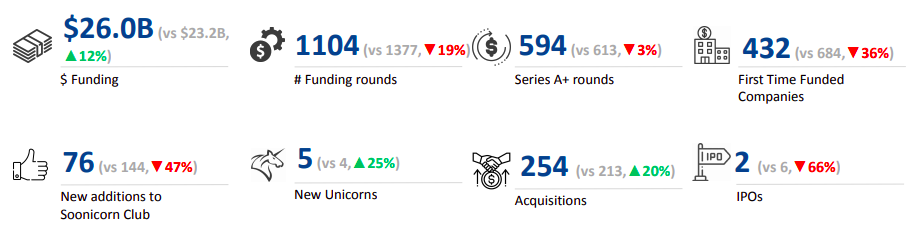

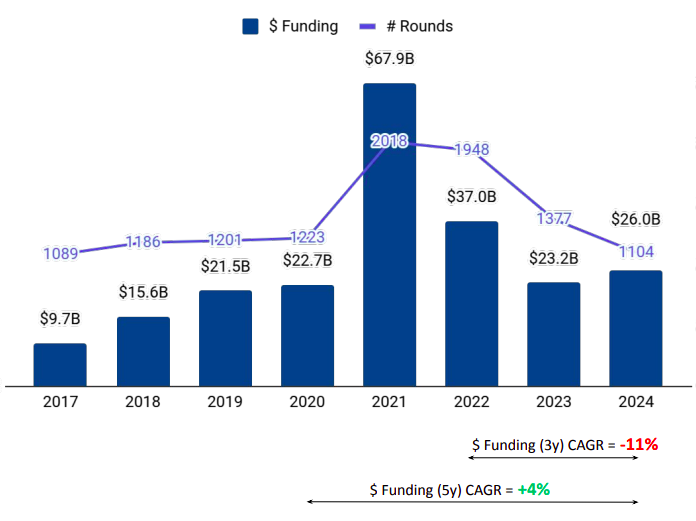

The US FinTech sector has remained at the forefront of technological advancements and investment activity, securing $26 billion in funding in 2024. This represents a 12% increase from the $23.2 billion raised in 2023 but a 30% decline from the $37 billion raised in 2022. Despite this fluctuation, the US remains the top-funded FinTech market globally, followed by the UK and India.

The FinTech ecosystem accounted for a significant portion of the overall funding in the US tech startup landscape, which saw a total funding of $156 billion in 2024.

Key drivers of FinTech innovation include the integration of AI, which enhances automation, security, and customer experience, as well as blockchain technology, which is streamlining financial transactions, reducing costs, and improving security.

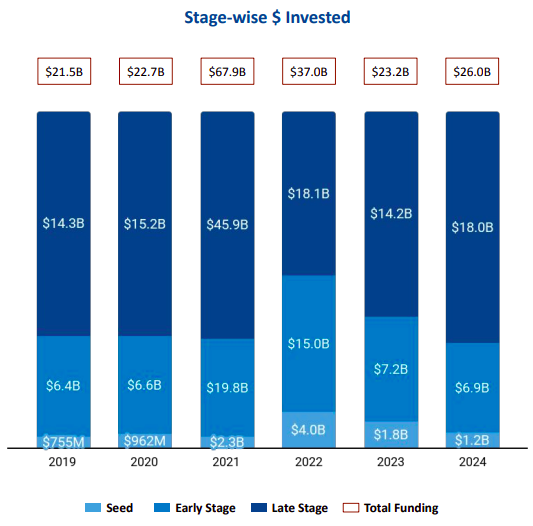

The sector attracted late-stage funding worth $18 billion in 2024, reflecting a 27% increase from the previous year (2023) and consistent with the $18.1 billion raised in 2022. Early-stage funding was $6.9 billion, a 4% drop from $7.2 billion in 2023 and a 54% decline from $15 billion in 2022. Seed-stage funding ($1.2 billion) was the most affected, marking a 33% decrease from $1.8 billion in 2023 and a 70% decrease from $4 billion in 2022.

The US FinTech ecosystem witnessed 35 rounds where the deal size was higher than $100 million, out of which four were $500 million and above. Databricks recorded the biggest funding round, securing $10 billion in a Series J round, increasing its valuation to $62 billion. Stripe raised $694 million in a Series I round, reaching a valuation of $70 billion.

Funding surged 97% to $17.3 billion in H2 2024 from $8.76 billion in H1 2024. This is also a 120% increase from the $7.86 billion raised in H1 2023. The highest-funded quarter with $14.5 billion across 222 rounds.

Investment Tech, Payments, and Finance & Accounting were the top funded segments in the US Fintech segment in 2024. Investment Tech companies garnered $3.85 billion in 2024, 8% higher than $3.57 billion in the previous year. Funding in the Payments sector declined 64% to $3.12 billion in 2024 from $8.76 billion in 2023. The Finance & Accounting Tech sector raised $2.84 billion, a 6% uptick from $2.67 billion in 2023.

In 2024, the US FinTech sector witnessed the emergence of five new unicorns, marking a slight increase from four in the previous year. Leading the charge was Merkle Manufactory, followed by Altruism, Sigma Computing, Sirion, and Aven, each achieving unicorn status amidst a backdrop of evolving market conditions.

Accompanying this unicorn surge, the year also saw a notable uptick in acquisition activity, totalling 254—an increase of 19% from 2023, but down 12% from 2022. Capital One's acquisition of Discover for $35.3 billion, Siemens' purchase of Altair for $10.6 billion, and Bain Capital's acquisition of Envestnet for $4.5 billion underscored strategic shifts and consolidation within the industry.

In contrast to the robust unicorn and acquisition activity, IPO activity in the US FinTech sector experienced a subdued year, with only two companies going public. Bitwise, a prominent cryptocurrency index fund company, led the charge with an IPO in January 2024, followed by Waystar, a healthcare revenue cycle management platform, in June 2024.

Geographically, San Francisco maintained its dominance as the primary hub for FinTech funding, securing $13.4 billion, followed by New York with $4.3 billion. Together, these two cities captured 69% of the total FinTech funding for the year, with Los Angeles contributing $938 million to the regional landscape.

Y Combinator, Techstars, and a16z emerged as the leading all-time investors. In 2024, Y Combinator, Techstars, and Plug and Play Tech Center dominated seed-stage funding. General Catalyst, Lightspeed Venture Partners, and Bessemer Venture Partners were the most active early-stage investors, while NewView Capital, CapitalG, and Bond Capital stood out as prominent backers in late-stage rounds.

As the US FinTech ecosystem continues to evolve, these developments underscore a resilient market adapting to both opportunities and challenges, setting the stage for further innovation and growth in the years ahead.

Despite fluctuations in funding across different stages, the US FinTech ecosystem demonstrated resilience in 2024, with continued investor interest, major funding rounds, and strategic acquisitions. AI and blockchain continue to be key drivers of innovation, positioning the US FinTech landscape for further transformation in the coming years.