Tracxn has released its US FinTech - 9M 2025 Funding Report, providing a comprehensive overview of the funding landscape across the United States. The report highlights a strong rebound in funding activity driven by a surge in late-stage investments, an increase in $100M+ funding rounds, and heightened IPO activity. Despite a modest decline compared to 2023, the ecosystem continued to demonstrate resilience, backed by robust investor participation and city-level diversity in capital inflows.

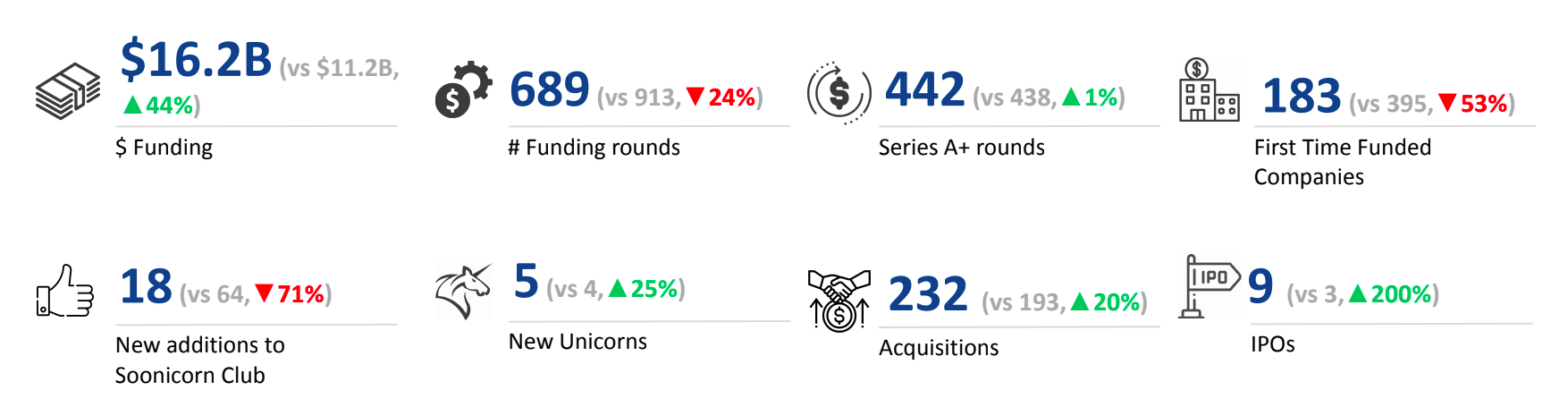

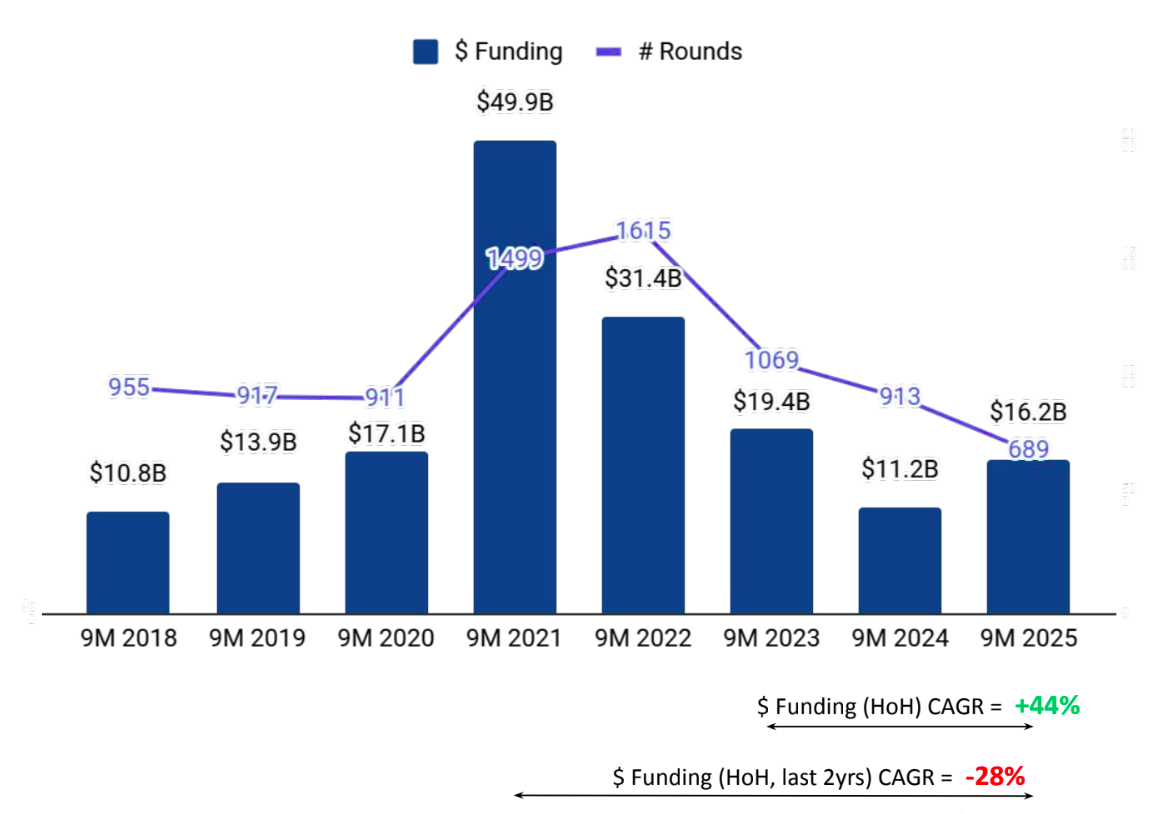

A total of $16.2B was raised by US FinTech companies in 9M 2025, marking a 44% increase from $11.2B in 9M 2024 and a 17% decline compared to $19.4B in 9M 2023. This upward momentum compared to the previous year reflects renewed investor confidence, with large late-stage deals significantly contributing to overall funding volume.

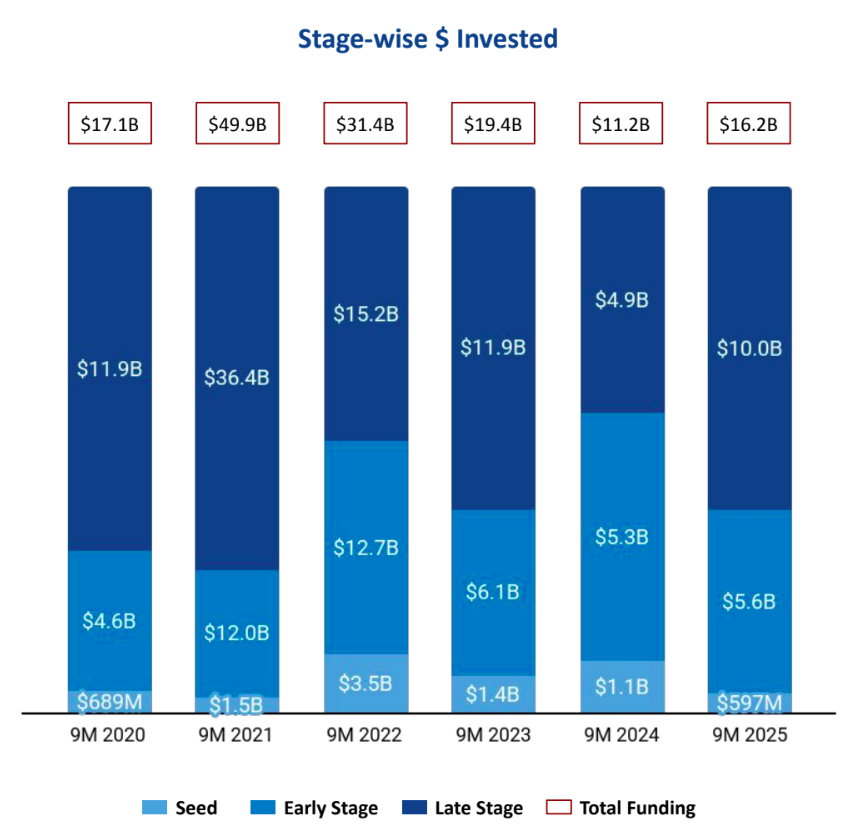

Seed-stage activity remained subdued, with startups raising $597 million in 9M 2025, down 46% from $1.1 billion in 9M 2024 and 57% below the $1.4 billion recorded in 9M 2023. Early-stage funding showed modest improvement, reaching $5.6 billion in 9M 2025, a 6% rise from $5.3 billion in 9M 2024, though still 8% lower than $6.1 billion in 9M 2023. Late-stage investments drove the year’s momentum, climbing to $10.0 billion, more than doubling (up 106%) from $4.9 billion in 9M 2024, even as they remained 16% below the $11.9 billion raised in 9M 2023. The rebound in large late-stage rounds was the key catalyst behind the overall funding recovery in 2025.

In 9M 2025, the US FinTech ecosystem recorded 28 $100M+ funding rounds, compared to 22 such rounds in 9M 2024 and 25 in 9M 2023. Notable large rounds included Acrisure’s $2.1B Series D, iCapital’s $820M Series E, and Plaid’s $575M Series E, alongside Ramp, which also secured funding exceeding $100M.

The period also saw heightened public market activity, with 9 FinTech IPOs, a 200% increase over 3 in 9M 2024 and an 80% rise compared to 5 in 9M 2023. Companies such as Gemini, Figure, Bullish, and Slide Insurance went public during this period. Additionally, 5 unicorns were created in 9M 2025, representing a 25% rise compared to 4 in 9M 2024 and a 67% increase from 3 in 9M 2023, reflecting sustained innovation and valuation growth in the FinTech space.

The US FinTech ecosystem witnessed 232 acquisitions in 9M 2025, a 20% rise compared to 193 acquisitions in 9M 2024, and a 46% increase from 159 acquisitions in 9M 2023. The most notable transaction was the $14.2B acquisition of Mr. Cooper by RocketCompanies, which stood as the highest-valued acquisition of the period. It was followed by the $9.0B acquisition of Core Scientific by CoreWeave, highlighting a strong year for consolidation in the sector.

New York City emerged as the leading FinTech hub in 9M 2025, accounting for 24% of total US funding, followed by San Francisco, which captured 19%. The concentration of capital in these two cities underscores their continued dominance in attracting large funding rounds and sustaining investor confidence across all stages of growth.

Investor participation remained robust and diverse across stages. At the Seed Stage, Y Combinator, BrokerTech Ventures, and General Catalyst emerged as the top investors. In the Early Stage, Accel, QED Investors, and New Enterprise Associates led investment activity. For Late Stage funding, Geodesic Capital, Cross Creek, and Bond Capital were the most active investors, reflecting their continued confidence in scaling FinTech ventures.

The US FinTech ecosystem displayed strong momentum in 9M 2025, marked by a 44% rebound in total funding, a doubling of late-stage investments, and a clear rise in IPO and acquisition activity. While seed funding declined, the overall ecosystem remained dynamic, supported by major rounds from companies such as Acrisure, iCapital, and Plaid, along with significant M&A transactions. New York City, accounting for 24% of total funding, led national investment inflows, followed by San Francisco with 19%, reinforcing their positions as the country’s leading FinTech hubs. Backed by active participation from both global and domestic investors, the US FinTech sector continued to demonstrate depth and resilience through 2025.