Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Quarterly Report: US FinTech Q1 2024. The report, based on Tracxn’s extensive database, provides insights into the US FinTech space.

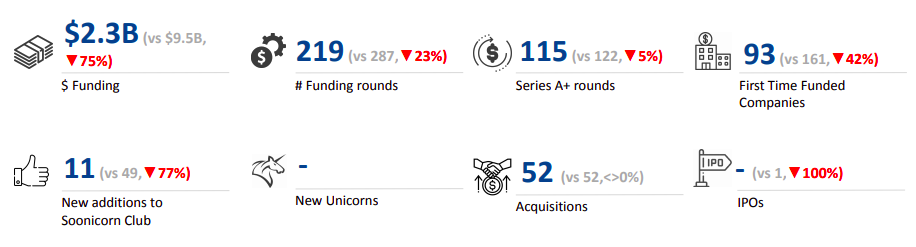

The US FinTech startup ecosystem is home to more than 36K companies and in Q1 2024, this space secured $2.3 billion in funding, representing 36% of the funding into the global FinTech sector ($6.3 billion).

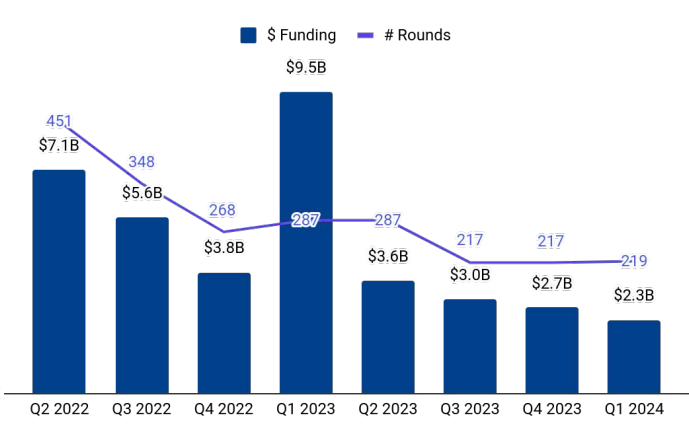

Q4 2021 was the highest funded quarter in this space, after which the funding started to experience a steady decline. Q1 2024 was the least funded quarter for the US FinTech space in the past five years. However, the US topped the list in country-wise funding in the FinTech sector in Q1 2024. This downward trend in investments can be attributed to the ongoing macroeconomic conditions, making investors more cautious in their investment decisions.

The US FinTech startup ecosystem secured total funding of $2.3 billion in Q1 2024, a 15% decline compared with $2.7 billion raised in the previous quarter (Q4 2023) and a 76% plunge from $9.5 billion raised in the corresponding quarter last year (Q1 2023).

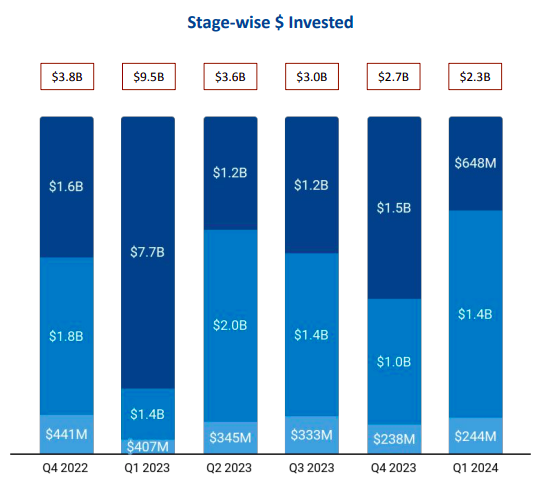

This drop in funding is majorly due to the massive drop in late-stage funding rounds. Late-stage funding Q1 2024 stood at $648 million, a 57% decline from $1.5 billion raised in Q4 2023 and a plummet of 92% compared with the $7.7 billion raised in Q1 2023.

On the other hand, an uptick was observed in seed and early-stage investments. Early-stage funding in Q1 2024 rose 40% to $1.4 billion in the first three months of 2024, from $1 billion raised in Q4 2023. A similar level was observed in the corresponding quarter last year, when this sector raised late-stage funding worth $1.4 billion.

Seed-stage funding saw a slight uptick of 3% to $244 million from $238 million raised in the previous quarter. However, this is a 40% drop from the $407 million raised in Q1 2023.

Only four $100 million+ funding rounds were recorded in Q1 2024. Bilt Rewards raised $200 million in a Series B round at a post-money valuation of $3.1 billion, while Watershed raised $100 million in a Series C round at a valuation of $1.8 billion. EigenLayer and FundGuard raised $100 million each in Series B and Series C rounds, respectively.

The US FinTech space has not seen any IPOs for three consecutive quarters, including Q1 2024. Further, the number of acquisitions rose to 52 in Q1 2024 from 39 in the previous quarter.

Investment Tech, Payments, and Finance & Accounting Tech were the top-performing sectors based on funding in Q1 2024. The Investment Tech sector secured $573 million in funding in Q1 2024, a 34% fall from the $864 million raised in the previous quarter. This is also a 19% drop compared with the $711 million raised in Q1 2023.

The Payments segment attracted investments worth $410 million in Q1 2024, a 90% jump from $216 million raised in Q4 2023, but a decrease of 94% compared with $7.21 billion raised in Q1 2023.

Finance & Accounting Tech is the third highest funded segment in Q1 2024 in the overall sector, receiving $391 million, a 41% increase compared with the $278 million funding witnessed in Q4 2023, 46% growth compared to $268 million raised in Q1 2023.

New York City ($740 million), San Francisco ($522 million), and Boston ($111 million) were the top-funded cities in the US FinTech startup ecosystem in Q1 2024. FinTech companies based in New York accounted for 32% of the overall funding, while those based in Boston contributed 22% to the overall funding.

Y Combinator, Techstars, and a16z are the all-time most active investors in the US FinTech space. FJ Labs, Zigg Capital, and Electric Capital are the leading investors in the seed stage in Q1 2024, while Bessemer Venture Partners, Lightspeed Venture Partners, and Sequoia Capital were the most active early-stage investors. EDBI and Key1 Capital were the top late-stage investors in Q1 2024.