Tracxn has released its Q1 2025 US FinTech Report, offering an in-depth view of investment trends in the world's largest FinTech startup ecosystem. With over 44.1K companies and more than 12.5K funded startups, the US continues to lead globally. However, funding activity witnessed a significant pullback in Q1 2025, reversing a brief uptick seen in Q4 2024. The ecosystem is currently home to 148 active FinTech unicorns and 9 active decacorns.

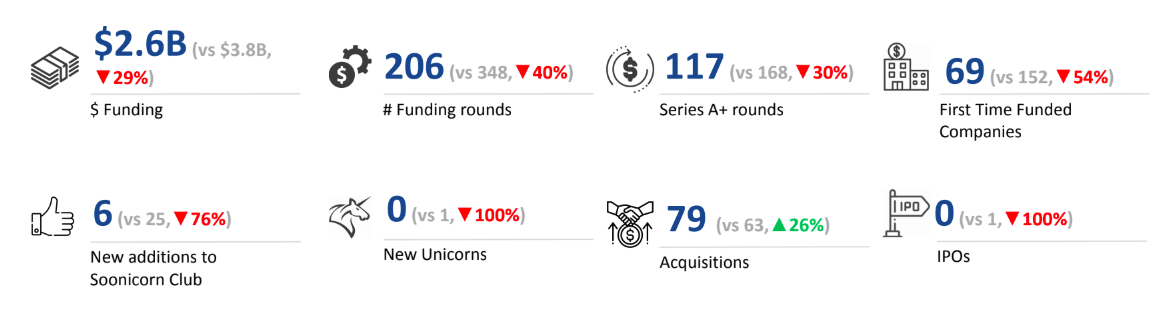

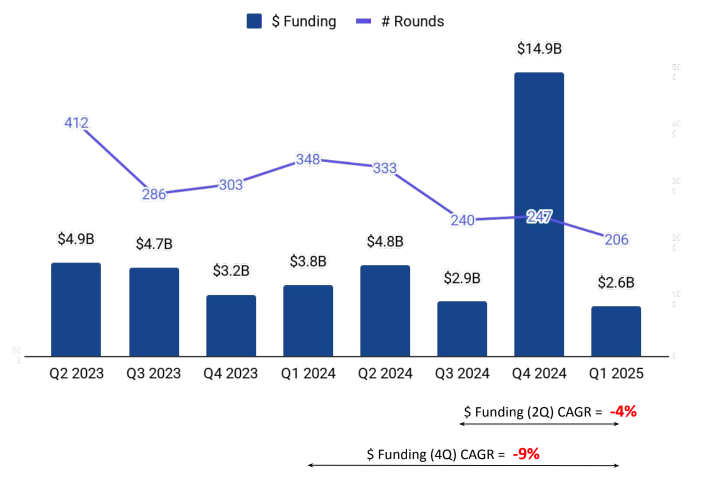

The US FinTech ecosystem raised a total of $2.6B in Q1 2025, marking a 29% drop from $3.8B in Q1 2024 and an 83% drop from $14.9B in Q4 2024. While Q4 2024 showed signs of recovery, Q1 2025 funding reverted to previous declining trends. The downturn is attributed to factors such as rising interest rates, geopolitical instability, and a shift in investor mindset toward more profitable business models.

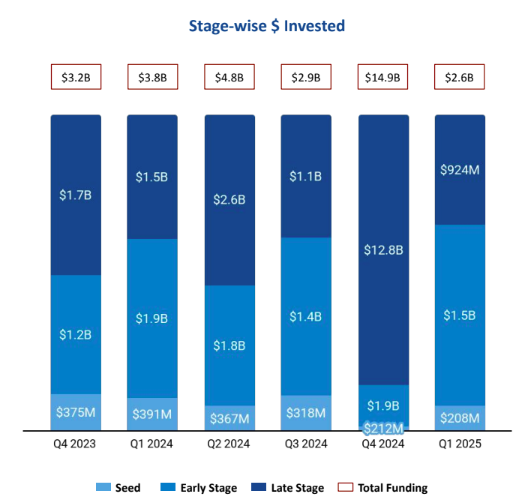

Late-stage funding in Q1 2025 amounted to $924M, a 38% decline from $1.5B in Q1 2024 and a steep 93% drop from $12.8B in Q4 2024. Early-stage rounds saw $1.5B in Q1 2025, down 21% compared to $1.9B in both Q1 2024 and Q4 2024. Seed-stage funding totaled $208M, a 47% fall from $391M in Q1 2024 and a 2% drop from $212M in Q4 2024. January was the strongest month of the quarter, raising $1.12B - 43% of Q1 2025's total funding.

Finance and Accounting Tech emerged as the top-funded segment in Q1 2025 with $546M, reflecting a 9% growth from $499M in Q1 2024 but a 51% decline from $1.11B in Q4 2024. Cryptocurrencies followed with $480M, a 23% increase from $391M in Q1 2024 and a 233% surge from $144M in Q4 2024. The Investment Tech segment received $324M, registering a 66% decrease from $955M in Q1 2024 and a 69% drop from $1.04B in Q4 2024.

Only two $100M+ funding rounds were recorded in Q1 2025, compared to 9 in Q1 2024 and 13 in Q4 2024. Notable rounds included Phantom raising $150M in a Series C round, pushing its valuation to $3B, and Openly securing $123M in a Series E round. OnPay raised $63M in a Series B round, and CMG received $30M in a Series C round. No IPOs were observed in Q1 2025, in contrast to one each in Q4 2024 and Q1 2024. Additionally, the US FinTech ecosystem did not witness any new unicorns in Q1 2025, compared to one in Q1 2024 and none in Q4 2024.

A total of 79 acquisitions took place in Q1 2025, up 26% from 63 in Q1 2024 and a 3% increase from 77 in Q4 2024. Major transactions included Rocket Mortgage’s $9.4B acquisition of Mr. Cooper, Munich Re’s $2.6B acquisition of Next Insurance, and Kraken’s $1.5B acquisition of NinjaTrader.

San Francisco led the US FinTech funding landscape in Q1 2025 with $888M, accounting for 34% of total funds raised. It was followed by New York with $392M and Boston with $171M.

Y Combinator, Techstars, and a16z emerged as the top investors in the US FinTech ecosystem during Q1 2025. At the seed stage, Y Combinator, Castle Island Ventures, and Sentinel Global led investments. Ribbit Capital, Lightspeed Venture Partners, and Nyca Partners were the top early-stage investors. Geodesic Capital, Cross Creek, and PSG topped late-stage investment activity.

The US FinTech ecosystem saw a sharp decline in funding in Q1 2025, reversing a brief rebound in the previous quarter. Despite remaining the world’s largest FinTech market by number of companies and funded startups, the quarter recorded no new unicorns or IPOs and only two mega-deals. Finance & Accounting Tech and Cryptocurrencies led sector funding, while acquisition activity picked up with several billion-dollar M&A transactions. San Francisco continued to dominate as the top investment hub, with strong participation from leading global and domestic VC firms across funding stages.

Uwin