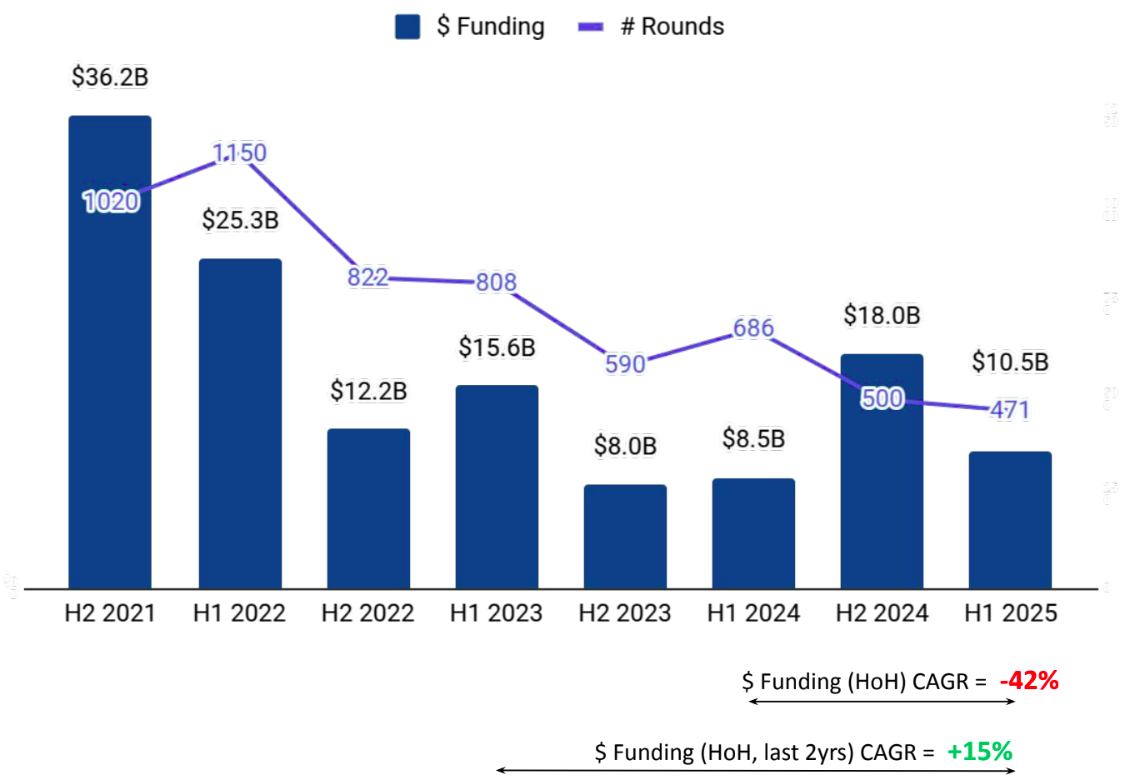

Tracxn has released its H1 2025 US FinTech funding report, covering investment trends, startup activity, and investor participation from January to June 2025. The report highlights a notable decline in overall funding across most stages, offset in part by increased acquisition activity and the emergence of two new unicorns.

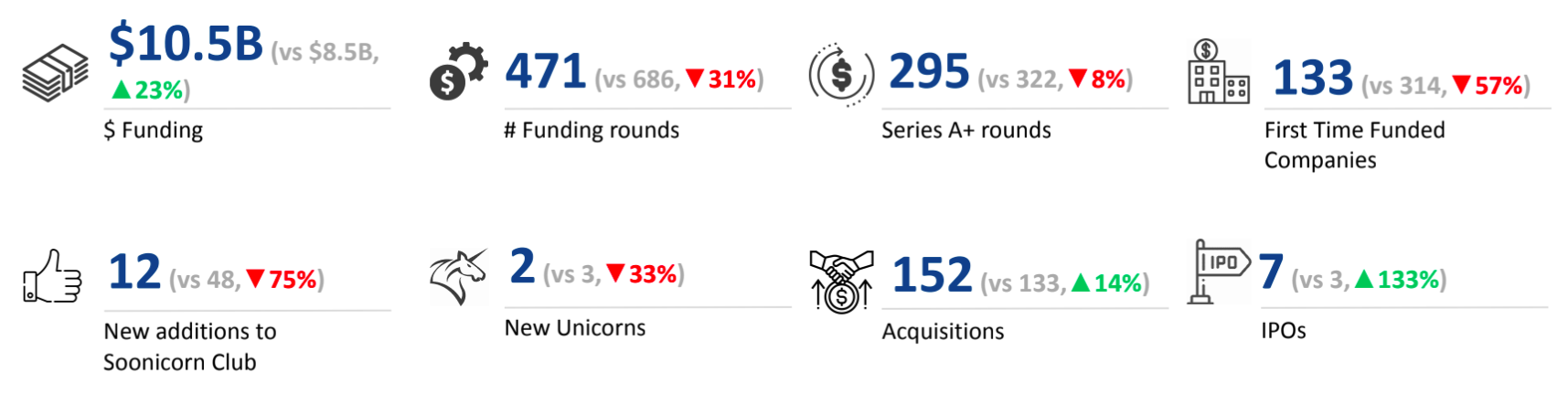

A total of $10.5B was raised in H1 2025, marking a 42% drop compared to the $18.0B raised in H2 2024. However, this represented a 23% increase compared to the $8.5B raised in H1 2024, signaling some resilience despite quarter-over-quarter decline.

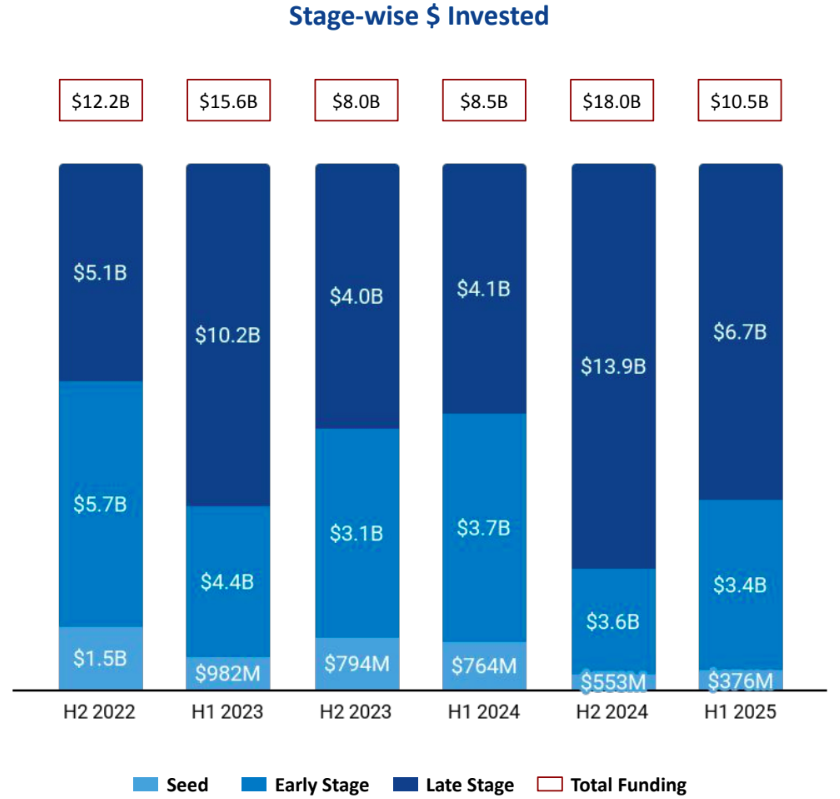

Seed stage saw a total funding of $376M in H1 2025, a drop of 32% compared to $553M raised in H2 2024, and a drop of 51% compared to $764M raised in H1 2024. Early stage saw a total funding of $3.4B in H1 2025, a drop of 6% compared to $3.6B raised in H2 2024, and a drop of 8% compared to $3.7B raised in H1 2024. Late stage witnessed a total funding of $6.7B in H1 2025, a drop of 52% compared to $13.9B raised in H2 2024, and an increase of 63% compared to $4.1B raised in H1 2024.

The count of $100M+ funding rounds in H1 2025 stood at 17, compared to 19 in H2 2024 and 17 in H1 2024. Companies like Acrisure, Plaid, Addepar, Persona, and Ramp have managed to raise funds above $100M in this period. Acrisure has raised a total of $2.1B in a Series D round. Plaid has raised a total of $575M in a Series E round. Addepar has raised a total of $230M in a Series G round. Slide Insurance, Chime, and Circle were some of the companies that went public in H1 2025. There were 2 unicorns created in H1 2025, a rise of 100% compared to 1 in H2 2024, and a drop of 33% compared to 3 in H1 2024.

Companies in the US FinTech space saw 152 acquisitions in H1 2025, which is a 9% increase as compared to 140 acquisitions in H2 2024 and a rise of 14% compared to 133 acquisitions in H1 2024. Mr. Cooper was acquired by RocketCompanies at a price of $9.4B. This became the highest valued acquisition in H1 2025, followed by the acquisition of Next Insurance by ERGO at a price of $2.6B.

FinTech companies in San Francisco received 25% of all funding raised in H1-2025. Grand Rapids was close behind with 20%.

Y Combinator, Techstars, and a16z were the overall top investors in the US FinTech ecosystem. Y Combinator, BrokerTech Ventures, and General Catalyst were the top seed stage investors in the US FinTech ecosystem for H1 2025. Accel, QED Investors, and Ribbit Capital were the top early stage investors in the US FinTech ecosystem for H1 2025. Bond Capital, Geodesic Capital, and DST Global Partners were the top late stage investors in the US FinTech ecosystem for H1 2025. Among VCs, United States-based General Catalyst led the most number of investments in H1 2025 with 28 rounds, while another United States-based fund a16z added 24 new companies to its portfolio.

H1 2025 marked a significant pullback in US FinTech funding, especially across late-stage deals. A small rebound in unicorn creation and continued high-value deals, along with increased M&A activity, signal continued investor interest in mature and scalable FinTech models. Leading cities and active VCs played a central role in driving momentum through a cautious first half of the year.