Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Semi-Annual Report: US FinTech H1 2024. The report, based on Tracxn’s extensive database, provides insights into the US FinTech space.

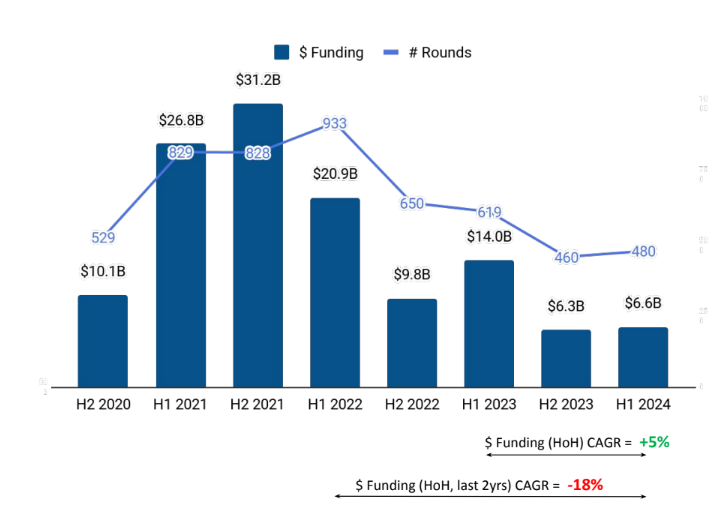

The US FinTech startup ecosystem has been the largest FinTech ecosystem on a global scale in terms of funding and the number of companies. The rise in interest rates, geopolitical instability and shift in investor mindset towards profitability, along with other factors, has resulted in a slowdown in funding.

Despite these factors, the sector has displayed a small improvement in funding in H1 2023, indicating positive growth in the coming period.

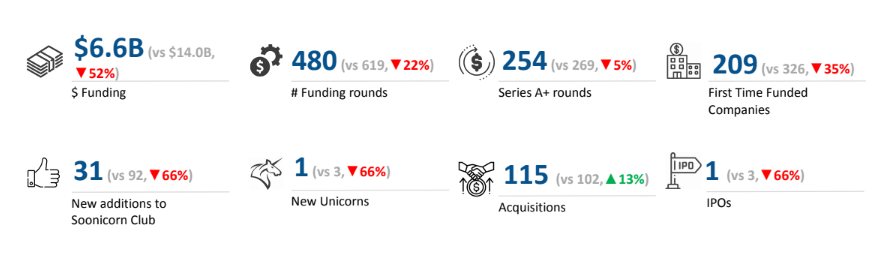

The US FinTech startup ecosystem secured total funding of $6.6 billion in H1 2024, a growth of 5% compared with the $6.3 billion raised in H2 2023 and a decline of 53% compared to the $14 billion raised in H1 2023.

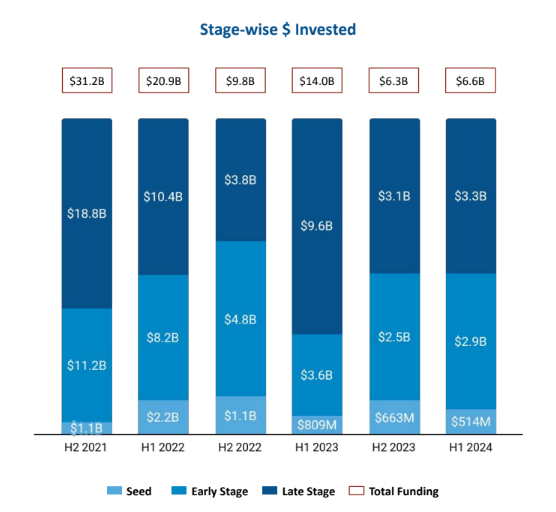

Seed-stage funding fell 36% to $514 million in H1 2024 from $809M raised in the first half of 2023. Early-stage investments stood at $2.9 billion in the first half of 2024, a 19% decline from the $3.6 billion raised in H1 2023. The sector attracted late-stage funding of $3.3 billion in H1 2024, a 66% plunge compared with the $9.6 billion raised in the first half of 2023.

A total of twelve $100M+ funding rounds were reported in H1 2024, of which two raised funds above $500 million in H1 2024. Stripe secured funding of $694 million in its Series I round, while AlphaSense, raised $650 million in its Series F funding round.

Altruist was the only company to become a Unicorn, after raising $169 million in a Series E funding round with a valuation of $1.5 billion.

Q2 2024 was the highest funded quarter in the US FinTech startup ecosystem in H1 2024 with $3.98 billion raised, a 49% growth over $2.65 billion raised in Q1 2024.

Investment Tech, Payment and Finance & Accounting Tech were the top-performing segments in the US FinTech sector in H1 2024. Funding in the Investment Tech segment fell 16% to $1.75 billion in H1 2024 from $2.08 billion in H1 2023. Companies in the Payments sector raised $1.67 billion in the first six months of 2024, a plummet of 78% compared with the $7.7 billion raised in H1 2023.

The Finance & Accounting Tech segment witnessed total funding of $1.17 billion in H1 2024, a 125% spike from the $521 million raised in H1 2023.

Uwin

Sports

Bitwise was the only Fintech company in the US to go public in the first half of 2024, while H1 2023 saw three IPOs. However, there was an improvement in the number of acquisitions, which rose from 102 in H1 2023 to 115 in H1 2024.

San Francisco and New York City took the lead in terms of total investments in the space in H1 2024. FinTech companies based in San Francisco raised $2.3 billion in the first half of 2024, while those based in New York City raised $1.5 billion.

Y Combinator, Techstars, and a16z are the all-time top investors in the US FinTech ecosystem. Y Combinator, Techstars, and Plug and Play Tech Center are the top seed investors in H1 2024, while QED Investors, Bessemer Venture Partners, and General Catalyst were the top early-stage investors in H1 2024. ICONIQ Growth, Bond Capital, and Sapphire Ventures were the top late-stage investors in H1 2024.