Tracxn has released its insights on the United States tech ecosystem for 2025, highlighting funding activity, sector performance, deal trends, and investor participation during the year. The United States remained the highest funded country globally in 2025, ahead of the United Kingdom and India, reflecting continued concentration of capital across mature and late-stage technology companies. The year was characterized by a sharp rise in total funding, strong late-stage momentum, active mega funding rounds, and sustained deal-making activity across acquisitions and public listings.

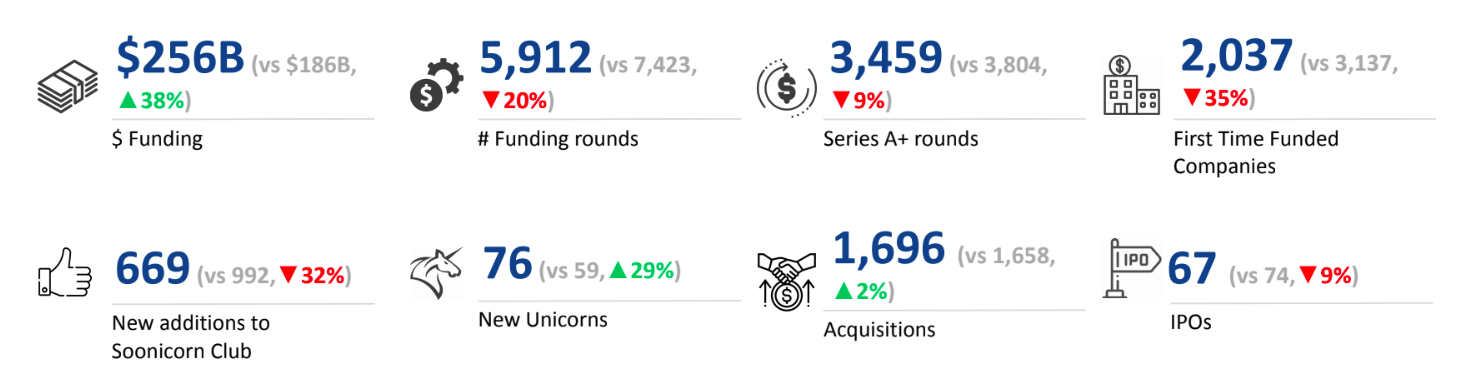

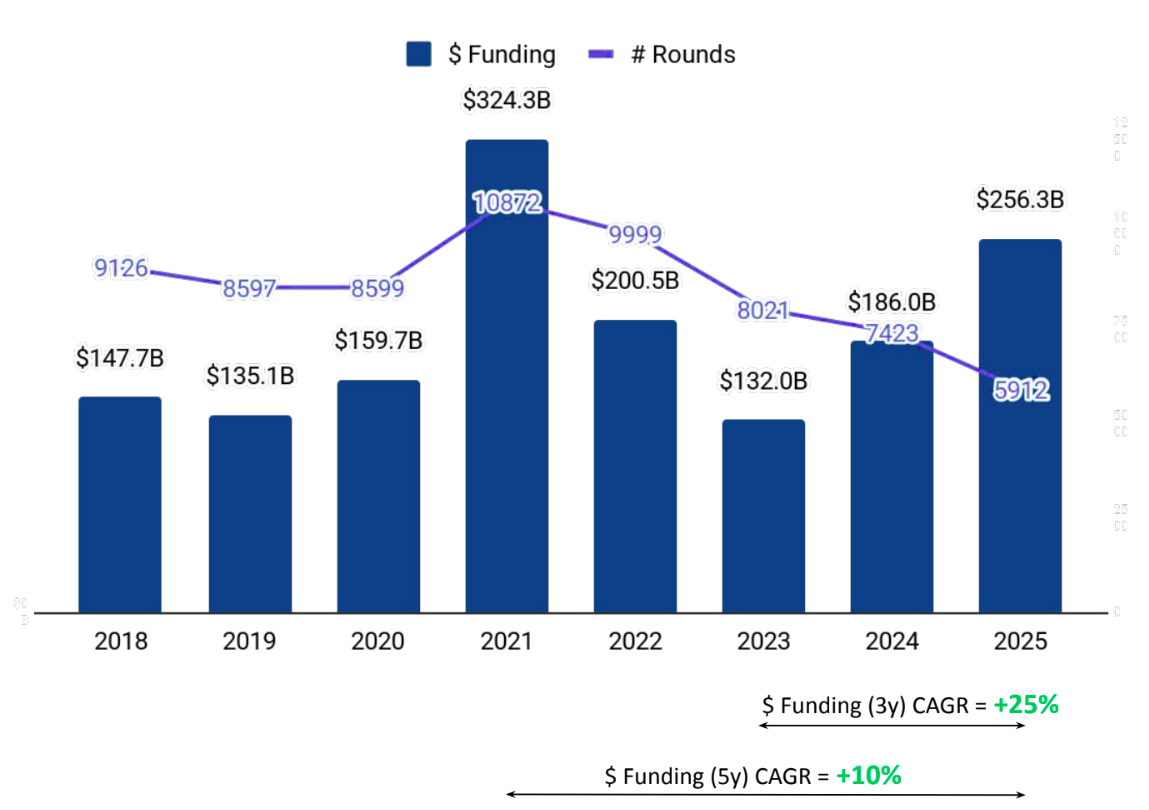

The US tech ecosystem raised a total of $256B in 2025. This represented a 38% increase compared to the $186B raised in 2024 and a 94% rise compared to the $132B raised in 2023. The increase in overall funding was driven primarily by late-stage capital inflows and a higher number of mega funding rounds during the year, with multiple large deals contributing significantly to total capital deployment.

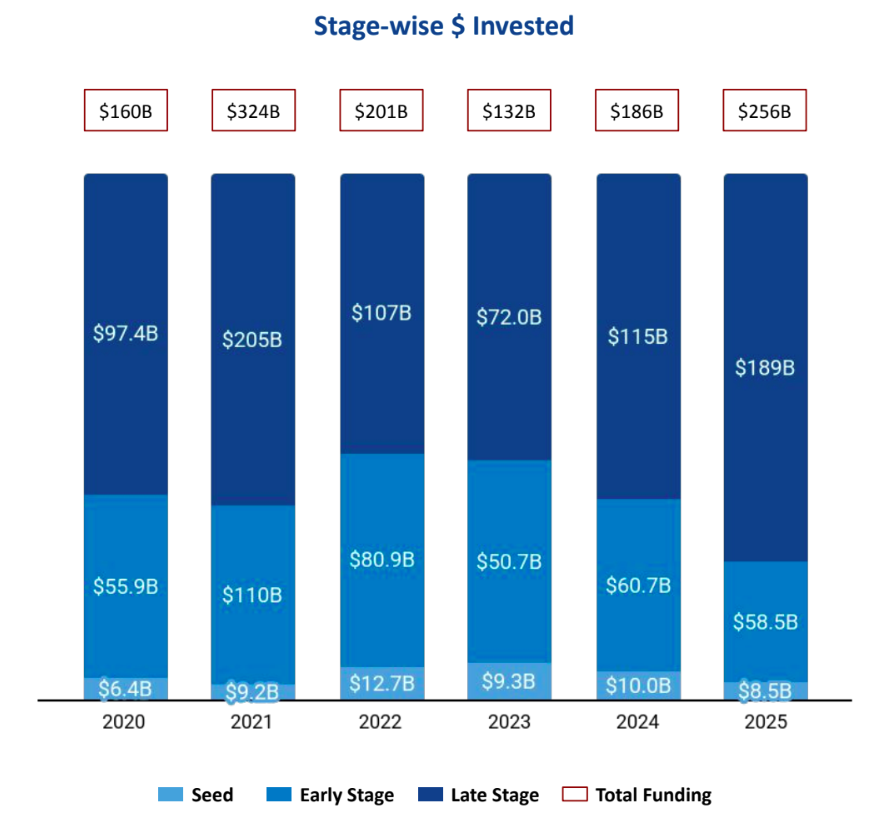

Seed-stage funding in the United States stood at $8.5B in 2025, reflecting a 15% decline compared to the $10B raised in 2024 and an 8% drop compared to the $9.3B raised in 2023. Early-stage funding totaled $58.5B in 2025, down 4% from $60.7B raised in 2024, while recording a 15% increase over the $50.7B raised in 2023. Late-stage funding witnessed a substantial rise, with $189B raised in 2025, representing a 64% increase from $115B in 2024 and a 163% increase compared to $72B raised in 2023. The dominance of late-stage investments played a central role in shaping overall funding outcomes for the year.

Enterprise Applications, Enterprise Infrastructure, and FinTech emerged as the top-performing sectors in the US tech ecosystem in 2025. The Enterprise Applications sector recorded total funding of $182B in 2025, marking a 72% increase compared to $106B raised in 2024 and a 161% increase compared to $69.9B raised in 2023. Enterprise Infrastructure saw total funding of $36.5B in 2025, which was a 15% decrease from $42.9B raised in 2024, while still representing a 124% increase over the $16.3B raised in 2023. FinTech funding reached $24.8B in 2025, reflecting a 55% rise compared to $16B raised in 2024 and a 10% increase compared to $22.6B raised in 2023.

The US tech ecosystem witnessed 26 mega funding rounds in 2025, compared to 18 such rounds in 2024 and 8 in 2023. Companies such as OpenAI, Scale AI, and Anthropic raised substantial capital through mega funding rounds during the period. OpenAI raised a total of $40B in a Series F round, Scale AI raised $14.3B in a Series G round, and Anthropic raised $13B in a Series F round. A major share of the mega funding rounds during the year came from Enterprise Applications, Enterprise Infrastructure, & Aerospace, Maritime and Defense Tech.

In terms of public listings, US tech recorded 67 IPOs in 2025, down 9% from 74 IPOs in 2024 and up 10% from 61 IPOs in 2023. In Silico, Starfighters Space, Wealthfront, and Bluerock were among the companies that went public during the year. The ecosystem also saw the creation of 76 unicorns in 2025, representing a 29% increase compared to 59 in 2024 and a 117% increase compared to 35 in 2023.

Tech companies in the United States completed 1,696 acquisitions in 2025. This marked a 2% rise compared to 1,658 acquisitions in 2024 and a 13% increase compared to 1,503 acquisitions in 2023. Among the largest deals, Electronic Arts was acquired by the Public Investment Fund, Silver Lake, and Affinity Partners at a price of $55B, making it the highest valued acquisition of 2025. This was followed by the acquisition of X by xAI at a price of $33B.

San Francisco-based tech firms accounted for 43% of all funding raised by tech companies across the United States in 2025. Palo Alto followed as the second-largest funded city, contributing 8% of the total funding during the year. These cities continued to serve as major hubs for capital concentration within the US tech ecosystem.

Investor participation remained strong across stages in 2025. Y Combinator, General Catalyst, and Alumni Ventures emerged as the top seed-stage investors in the US tech ecosystem during the year. At the early stage, Khosla Ventures, Sequoia Capital, and Lightspeed Venture Partners were the most active investors. Late-stage funding activity was led by Bond Capital, CapitalG, and SoftBank Vision Fund, which played a key role in supporting large and mega funding rounds across the ecosystem.

The United States tech ecosystem in 2025 recorded a significant rise in total funding, driven by strong late-stage activity and an increase in mega funding rounds. Total funding reached $256B, supported by growth in Enterprise Applications, Enterprise Infrastructure, and FinTech, while seed and early-stage funding showed mixed trends. The year also saw higher unicorn creation, sustained acquisition activity with large-ticket deals, and continued dominance of key cities such as San Francisco and Palo Alto, alongside active participation from leading investors across all funding stages.