Tracxn, a SaaS-based market intelligence platform, tracking 3.7M + entities worldwide, released its US Tech Annual Report 2024. The report throws light into the US Tech landscape, covering tech startups, funding dynamics, investor activity, exits, unicorns, and the key trends thereof.

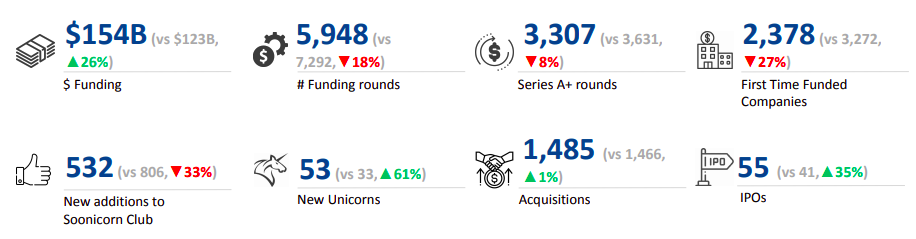

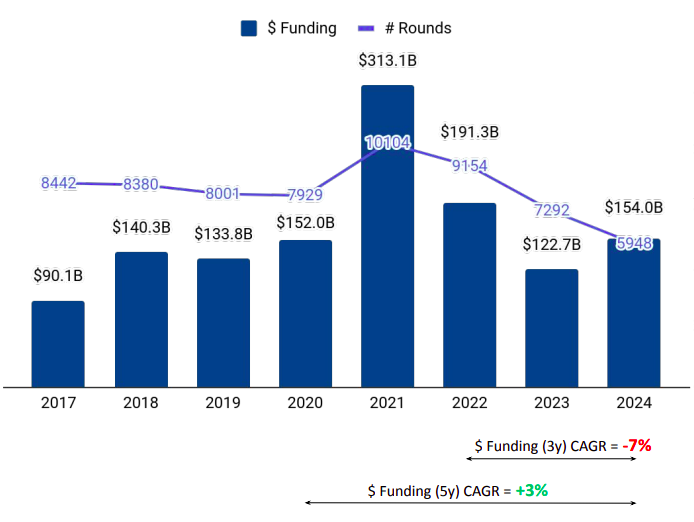

2024 Funding Amount Surpasses 2023 Despite Fewer Rounds, Q4 Contributes the Most US Tech received $154B funding in 2024, a 25.5% jump over $122.7B in 2023. Although the funding amount saw a trend reversal in 2024, the number of funding rounds continued to dip. A closer analysis reveals that the 2024 jump was mainly driven by Q4 2024. The total funding in the first nine months of 2024 stood at $94.5B, just shy of $97.1B secured in the same period in 2023. However, Q4 2024 saw a remarkable surge, with funding skyrocketing to $59.7B across 1394 rounds, compared to only $25.7B from 1665 rounds in Q4 2023. This dramatic increase in Q4 played a pivotal role in driving overall funding higher for 2024.

AI-Focussed Firms Dominate Bigger Funding Rounds in Q4

In 2024, there were 14 funding rounds exceeding $1B, compared to 6 such rounds in 2023. Q4 2024 alone saw six $1B+ funding rounds and four of them involved AI-Focussed Firms: Databricks ($10B), OpenAI ($6.6B), xAI ($6.0B), and Anthropic ($4.0B). Notable data center company, DataBank secured $2.0B funding in Series C. The rising valuation of AI-Focussed Firms highlights the rapid expansion and growing significance of artificial intelligence in US Tech.

Funding Concentration seen in San Francisco Bay Area and New York City In 2024, Top 3 funded locations were the San Francisco Bay Area ($81.4B), New York City ($13.6B) and Boston ($4.3B) accounting for 52.8%, 8.8% and 2.8% of total funding, respectively. This indicates concentration of investments in traditional hubs. San Francisco Bay Area dominance can be attributed to its extensive network of venture capital firms, incubators, and a rich ecosystem that supports startups.

HighTech, Enterprise Applications, and Enterprise Infrastructure were top 3 funded sectors The top-performing sectors in 2024 were High Tech, Enterprise Applications, and Enterprise Infrastructure. High Tech saw a 70.4% funding increase to $94.3B in 2024 compared to $55.3B in 2023. Enterprise Applications saw a 37.3 % funding increase to $87.5B in 2024 compared to $63.8B in 2023. Enterprise Applications saw a 158.4% funding increase to $30.6B in 2024 compared to $11.8B in 2023.

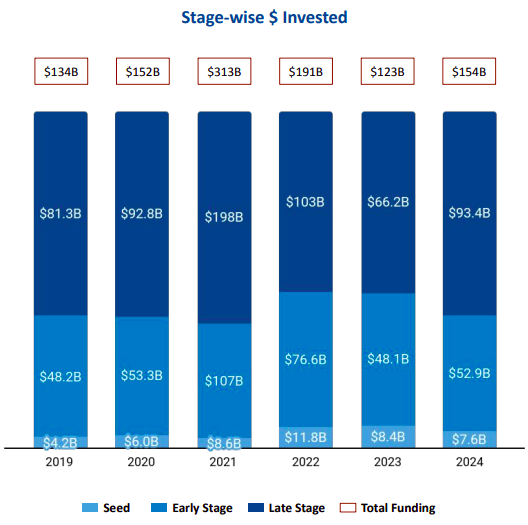

Shifting Dynamics: Seed Stage Funding Falls while Early and Late Stages Saw Uptick with Fewer Rounds

Seed-stage funding stood at $7.6B in 2024, a 9.5% drop compared to $8.4B in 2023, and 35.6% drop compared to $11.8B in 2022. Seed funding rounds hit a decadal low of 2641 in 2024, compared to 3661 in 2023, and 4386 in 20222. This indicates a tightening investment climate, where investors are becoming more selective and cautious, leading to fewer opportunities for startups at this critical stage. The most notable funding round was $1.0B secured by SSI, an AI-Focussed firm.

Early-stage funding stood at $52.9B in 2024, a 9.1% jump compared to $48.1B in 2023, but a 30.9% drop compared to $76.6B in 2022. The 9.1% jump in 2024 can be explained by a whooping $6B Series B funding secured by xAI, an AI-Focussed firm. The next biggest funding round was $675M, nearly one-tenth of xAI. Funding rounds hit a decadal low of 2540 in 2024, compared to 2841 in 2023, and 3603 in 2022.

Late-stage funding (including PE & Pre-IPO rounds) stood at $94.3B in 2024, a 42.4% jump compared to $66.2B in 2023, but a 8.4% drop compared to $103B in 2022. The 42.4% jump can be explained by 12 rounds of $1B+ funding in 2024, which amounted to $43B in total funding, compared to 7 such rounds in 2023, which amounted to $22.7B in total. It is worth noting that in 2024, AI-focused firms (Databricks, OpenAI, xAI, Anthropic, Xaira, and Scale) together raised $31.3B, around 72.3% of $43B.

First-Time Funded Startups falls by 27.3% in 2024

First Time Funded Startup totalled 2378 in 2024, a 27.3% decrease compared to 3272 in 2023, and a 43% decrease from 4174 in 2022. The continued downtrend of First Time Funded startups is mainly because of a significant drop in seed-stage Investments. Other reasons that may have contributed to this include economic challenges, high interest rates, inflationary pressures, or a more cautious investment climate.

Alumni Ventures and Andreessen Horowitz (a16z) were the Most Active VC in Seed Stage In 2024, the most active VCs to invest in Seed-stage were Alumni Ventures and a16z, each with 21 rounds.

General Catalyst were the Most Active VC to Invest in Early Stage

In 2024, General Catalyst emerged as the most active venture capital firm in early-stage investments, participating in 34 funding rounds.

In October of the same year, the firm announced the closing of approximately $8 billion in new capital, with $4.5 billion specifically allocated to core venture capital funds focused on seed and growth equity stages3. This indicates that General Catalyst may remain focused on early stage startups in years to come.

Sapphire Ventures was the Most Active Late Stage VC

In 2024, Sapphire Ventures was the Most Active Late Stage VC to make 9 investments.

IPO count jumped by 34.2% to 55

In 2024, US Tech witnessed 55 IPOs, a 34.2% rise from 41 in 2023, likely due to companies delaying IPOs in 2023 amid unfavorable market conditions. Also, this number is quite less than the peak of 310 seen in 2021.

Number of acquisitions remained flat, while average acquisition price dropped Acquisitions nearly remained flat in 2024 with 1,485 deals compared to 1,466 in 2023. The highest valued acquisition in 2024 was Discover, acquired by Capital One at a price of $35.3B. Average Acquisition price in 2024 was dipped to $1.5B compared to $1.8B in 2023, indicating a cautious investment climate.

US Tech saw 53 Unicorns in 2024

The number of Unicorns in 2024 in US Tech stood at 53, a 60.6% jump from 33 in 2024. However, this is significantly less than 300+ in the peak year of 2021. Perplexity, an AI-Focussed firm, which became a unicorn in Q2 2024, has now reached a valuation of $9B in Dec 2024, nearly a 3x jump in valuation when it became Unicorn earlier in 2024.

Future Outlook: N8

Four key events that are likely to shape up the funding landscape in 2025 are Policies of the new administration and federal antitrust agencies,US Fed Rate Cut, SoftBank’s $100B investment commitment and Restrictions on investing in China.

Policy Shifts and Regulations:

The policies of the new administration and federal antitrust agencies are expected to influence the overall funding landscape, including key sectors such as AI, cryptocurrency, eVTOL, and CleanTech.

US Fed Rate Cuts:

Anticipated gradual and modest interest rate cuts may prompt venture capitalists (VCs) and high-net-worth individuals (HNWIs) to adopt a cautious approach, impacting funding dynamics.

SoftBank’s $100B Investment Commitment:

SoftBank’s substantial investment in technologies such as AI is expected to channel significant funding into AI-focused startups, among other areas, with both direct and ripple effects on the broader funding ecosystem.

Restrictions on China Investments:

Effective January 2, 2025, the US implemented restrictions on investments in tech companies in China, Hong Kong, and Macau, citing national security concerns. This is likely to divert US-based VC funds toward domestic startups or other growth regions, potentially driving up valuations in areas like AI.