Tracxn has released its United States Tech - 9M 2025 Report, highlighting key funding and investment trends across the US technology ecosystem for the first nine months of 2025. The United States emerged as the highest-funded country globally, ahead of the United Kingdom and India, underscoring its continued dominance in the global tech investment landscape. The report reveals a surge in overall funding driven primarily by late-stage mega rounds in sectors such as Enterprise Applications and Enterprise Infrastructure.

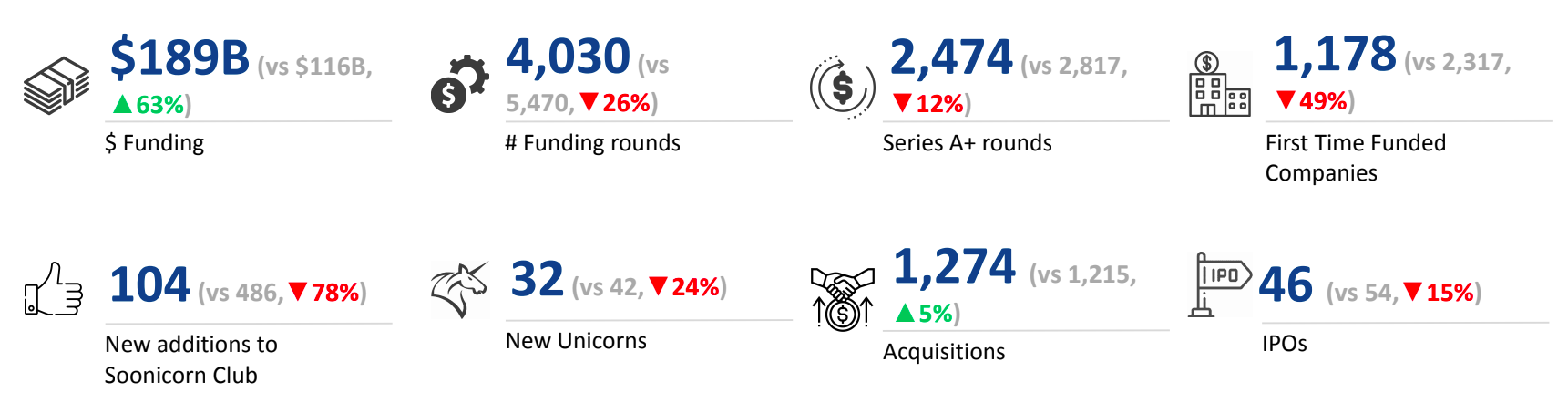

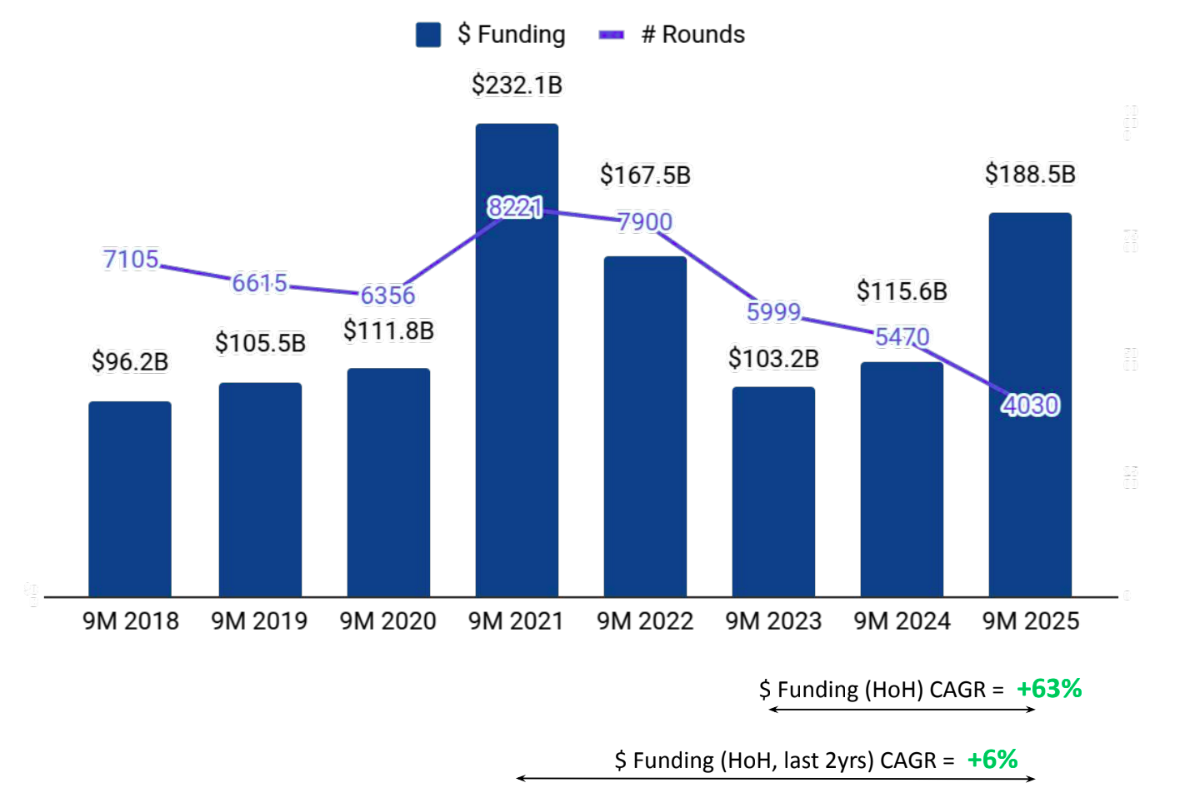

The US tech ecosystem witnessed a significant upswing in funding activity in 9M 2025, raising a total of $189B, a 63% rise compared to $116B raised in 9M 2024, and an 83% increase compared to $103B raised in 9M 2023. This growth was largely driven by a resurgence in late-stage funding and multiple $1.0B+ rounds across AI and enterprise sectors.

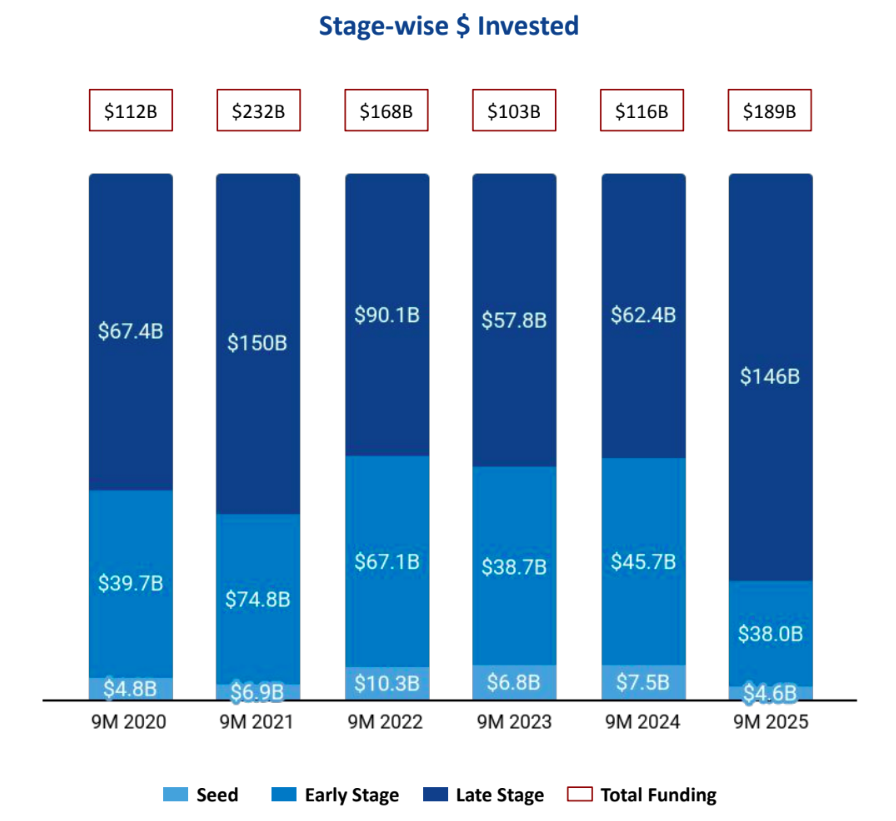

Funding activity across stages showed contrasting trends. Seed Stage funding stood at $4.6B in 9M 2025, marking a 39% decline compared to $7.5B in 9M 2024, and a 32% drop compared to $6.8B in 9M 2023. Early Stage funding reached $38.0B, representing a 17% decline from $45.7B in 9M 2024 and a 2% decrease compared to $38.7B in 9M 2023.In contrast, Late Stage funding surged to $146B in 9M 2025, a 133% rise compared to $62.4B in 9M 2024 and a 153% increase compared to $57.8B in 9M 2023, highlighting strong investor participation in mature, high-value ventures.

Enterprise-focused sectors dominated the US tech landscape in 9M 2025. Enterprise Applications led with $138B in total funding, an increase of 139% compared to $57.8B in 9M 2024 and 138% compared to $58.0B in 9M 2023. Enterprise Infrastructure followed with $22.3B, showing a 6% decrease from $23.7B in 9M 2024 but a 105% increase compared to $10.8B in 9M 2023. FinTech ranked third with $16.1B in funding, up 43% from $11.2B in 9M 2024 but down 17% from $19.4B in 9M 2023.A major portion of the $1.0B+ funding rounds originated from Enterprise Applications, Enterprise Infrastructure, and Aerospace, Maritime and Defense Tech, underscoring investor appetite in these segments.

The US tech sector recorded 17 $1.0B+ funding rounds in 9M 2025, compared to 11 such rounds in 9M 2024 and 6 in 9M 2023. Companies including OpenAI, Scale AI, Anthropic, xAI, and World View secured billion-dollar rounds during this period. OpenAI raised $40.0B in a Series F round, Scale AI raised $14.3B in a Series G round, while Anthropic raised a total of $16.5B across two rounds - $13.0B (Series F) and $3.5B (Series E).

On the public markets front, 46 IPOs were recorded in 9M 2025, down 15% from 54 in 9M 2024, but up 7% from 43 in 9M 2023. Notable listings included Netskope, StubHub, Via, and Gemini. In terms of unicorn creation, the period saw 32 new unicorns, a 24% drop from 42 in 9M 2024 but a 33% rise compared to 24 in 9M 2023.

The US tech ecosystem witnessed 1,274 acquisitions during 9M 2025, marking a 5% rise from 1,215 deals in 9M 2024 and a 10% increase from 1,157 in 9M 2023. The standout transaction of the period was Electronic Arts’ $55.0B acquisition by the Public Investment Fund, Silver Lake, and Affinity Partners, making it the largest deal of 9M 2025. The second-largest was xAI’s $33.0B acquisition of X, further underscoring the strong M&A activity in the US tech landscape.

San Francisco-based tech firms accounted for 50% of all funding raised by US tech companies in 9M 2025, maintaining their position as the dominant innovation hub. New York City ranked second, contributing 5% of the total funding during the same period.

Prominent investors continued to drive deal activity across stages. Y Combinator, General Catalyst, and South Park Commons emerged as the top seed-stage investors in the US tech ecosystem. Khosla Ventures, Sequoia Capital, and Lightspeed Venture Partners led early-stage investments, while Bond Capital, SoftBank Vision Fund, and Sapphire Ventures dominated late-stage funding.

The United States tech ecosystem demonstrated robust funding momentum in 9M 2025, fueled by a surge in late-stage investments and large-scale rounds led by companies like OpenAI, Scale AI, and Anthropic. Despite declines in seed and early-stage activity, total funding rose sharply, with Enterprise Applications and Enterprise Infrastructure emerging as key growth drivers. Acquisitions and IPOs remained active, further highlighting investor confidence in mature tech ventures.