Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Quarterly Report: US Tech Q3 2024. The report, based on Tracxn’s extensive database, provides insights into the US Tech space.

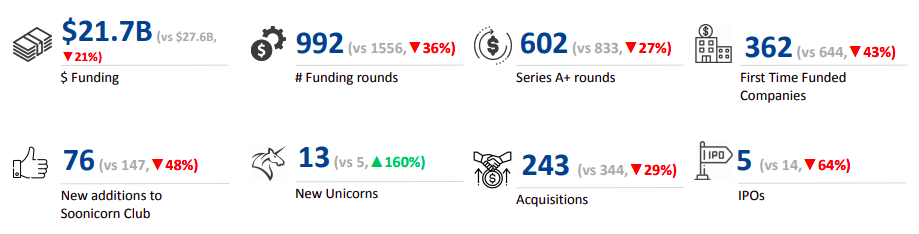

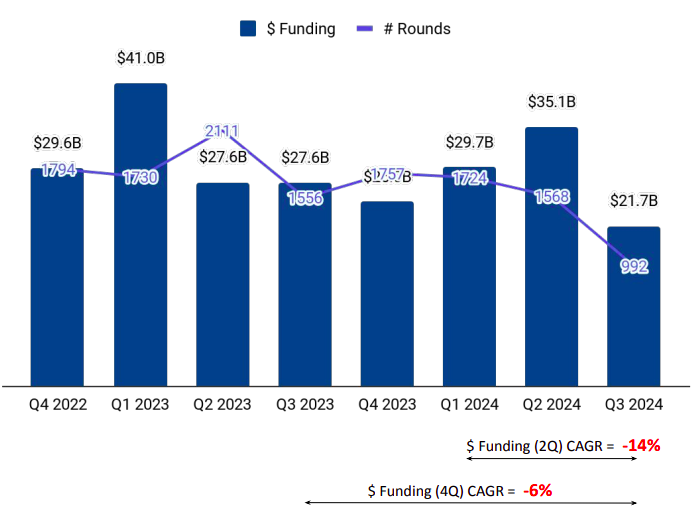

The United States remained the highest-funded country in Q3 2024. US-based tech startups raised $21.7 billion, a drop of 38.15% compared to $35.08 billion raised in the previous quarter (Q2 2024). This is also 21.38% lower than the $27.60 billion raised in the corresponding quarter last year (Q3 2023).

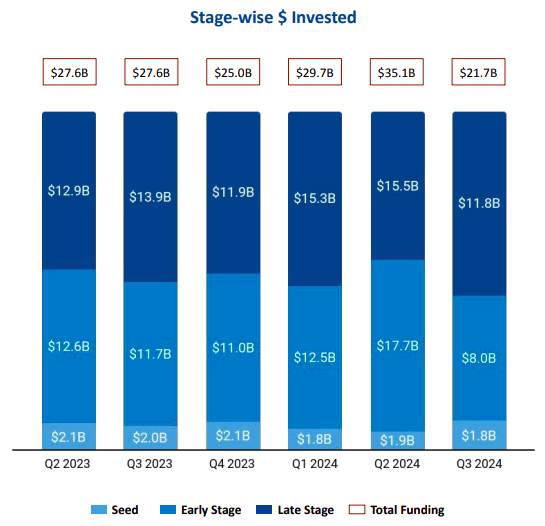

Late-stage funding fell 23.59% to $11.82 billion in Q3 2024 from $15.47 billion raised in the previous quarter. The ecosystem secured seed-stage investments worth $1.84 billion in the third quarter of this year, a minor drop of 1.6% compared with the $1.87 billion raised in Q2 2024. Early-stage funding fell 54.63% to $8.03 billion in Q3 2024 from $17.7 billion raised in Q2 2024.

Thirteen new unicorns emerged in Q3 2024, a massive improvement from five unicorns in Q3 2023. The country’s tech startup landscape witnessed forty-four 100M+ funding rounds during the quarter, of which two were higher than $1 billion. Anduril raised a total of $1.5 billion in a Series F round led by Founders Fund, valuing the company at over $14 billion, while SSI raised a total of $1 billion in a seed round led by NFDG, valuing the company at over $5 billion.

The top-performing sectors in Q3 2024 were High Tech, Enterprise Applications, and Enterprise Infrastructure. High Tech companies witnessed a 36% decline in funding in the third quarter of 2024, compared with Q2 2024. The Enterprise Applications segment saw a 52% drop in funding in Q3 2024 compared with the previous quarter. Funding raised by the Enterprise Infrastructure sector rose 8% in Q3 2024 compared to Q2 2024.

The number of acquisitions fell to 243 in Q3 2024, from 354 in Q2 2024 and 344 in the corresponding quarter in 2023. Only a handful of tech startups took the IPO route, with the number of IPOs falling to five in Q3 2024, as against 19 in Q2 2024 and 14 in Q3 2023. Bicara Therapeutics, Actuate Therapeutics, and OS Therapies were some of the companies that went public in Q3 of this year.

Tech startups based in San Francisco dominated the funding landscape, raising $4.4 billion in the third quarter of 2024. Companies based in New York City and Palo Alto raised $2.2 billion and $2.1 billion respectively during the same period.

Despite the overall decline in funding, the creation of unicorns indicates that investor sentiment is stable. The US startup ecosystem has displayed resilience amid challenges arising from the current global macroeconomic scenario.

*Data from 01-Jul-2024 to 17-Sep-2024 is considered in report