April 07, 2025: Tracxn has released its US Tech Q1 2025 funding report, highlighting significant growth in the United States tech investment landscape. The US emerged as the highest-funded country, ahead of the United Kingdom and India.

&zN8wj;

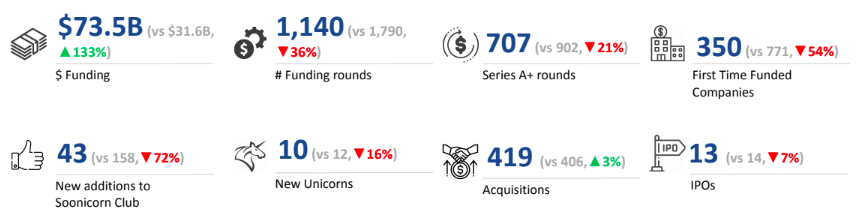

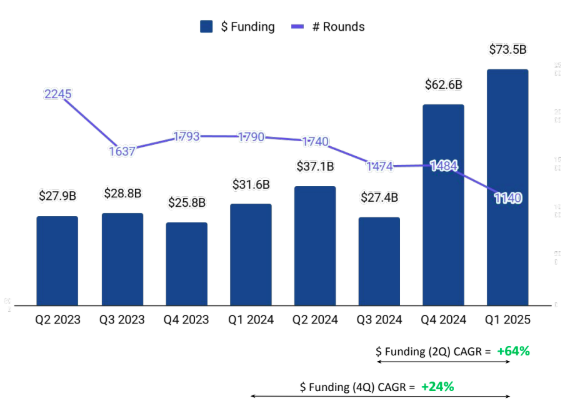

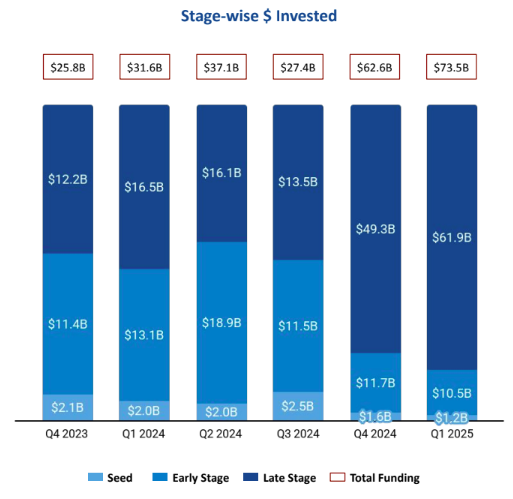

The US tech sector saw a total of $73.5B in funding in Q1 2025, a sharp increase from $62.6B in Q4 2024 (17%) and more than doubling the $31.6B raised in Q1 2024 (133%). Late-stage funding accounted for a significant portion, while early and seed-stage investments saw declines.

Seed-stage funding saw the steepest drop, totaling $1.2B, down 27% from $1.6B in Q4 2024 and 42% from $2B in Q1 2024. Early-stage funding dropped to $10.5B, declining 11% from $11.7B in Q4 2024 and 20% from $13.1B in Q1 2024. Late-stage funding reached $61.9B, marking a 26% QoQ increase from $49.3B in Q4 2024 and a substantial 275% YoY increase from $16.5B in Q1 2024.

Enterprise Applications dominated, raising $60.6B, reflecting a 53% QoQ increase from $39.5B in Q4 2024 and a massive 325% YoY growth from $14.3B in Q1 2024. Enterprise Infrastructure secured $7.7B, showing a 54% QoQ drop from $16.8B in Q4 2024 but a 103% YoY increase from $3.8B in Q1 2024. Life Sciences raised $4.9B, down 14% QoQ from $5.8B in Q4 2024 and 21% YoY from $6.3B in Q1 2024.

There were 66 funding rounds above $100M in Q1 2025, compared to 76 in Q4 2024 and 67 in Q1 2024. OpenAI led the largest funding rounds, raising $40B in a Series F round led by SoftBank Group, valuing the company at over $300B. Other notable rounds included Anthropic ($3.5B Series E, Lightspeed Venture Partners), Infinite Reality ($3B Series E, $12.2B valuation), and Saronic and Nerdio, which also raised $100M+ rounds.

10 unicorns were created in Q1 2025, a 16% decrease from 12 in Q1 2024. Companies that went public in this quarter included CoreWeave, NeOnc Technologies, Kestra Medical Technologies, and Brag House.

The US tech sector saw 419 acquisitions, marking a 13% QoQ increase from 372 in Q4 2024 and a 3% QoQ rise from 406 in Q1 2024. Johnson & Johnson acquired Intra-Cellular Therapies for $14.6B, making it the highest-valued acquisition in Q1 2025. The second-largest deal was Rocket Mortgage’s $9.4B acquisition of Mr. Cooper.

UwinSan Francisco-based tech firms received 67% of all US tech funding in Q1 2025, making it the leading city. Los Angeles followed at a distant second.

Y Combinator, New Enterprise Associates, and a16z emerged as the top investors in the US tech ecosystem. Y Combinator, Techstars, and South Park Commons were the most active seed-stage investors in India. SoftBank Vision Fund, PSG, and Cross Creek led late-stage investments in the US, while Lightspeed Venture Partners, General Catalyst, and Khosla Ventures were dominant in early-stage funding.

The US tech ecosystem showed strong momentum in Q1 2025, with a significant surge in funding and acquisitions. The dominance of Enterprise Applications, Enterprise Infrastructure, and Life Sciences highlights sustained investor interest in high-growth sectors. While seed and early-stage funding declined, late-stage investments fueled overall growth.