Tracxn has released its H1 2025 United States Tech Funding Report, highlighting the country’s continued dominance in the global tech investment landscape. With the highest tech funding globally for this period, the United States led ahead of the United Kingdom and India, driven by a surge in late-stage funding, a rise in $100M+ deals, and strong sectoral activity in Enterprise Applications and Infrastructure.

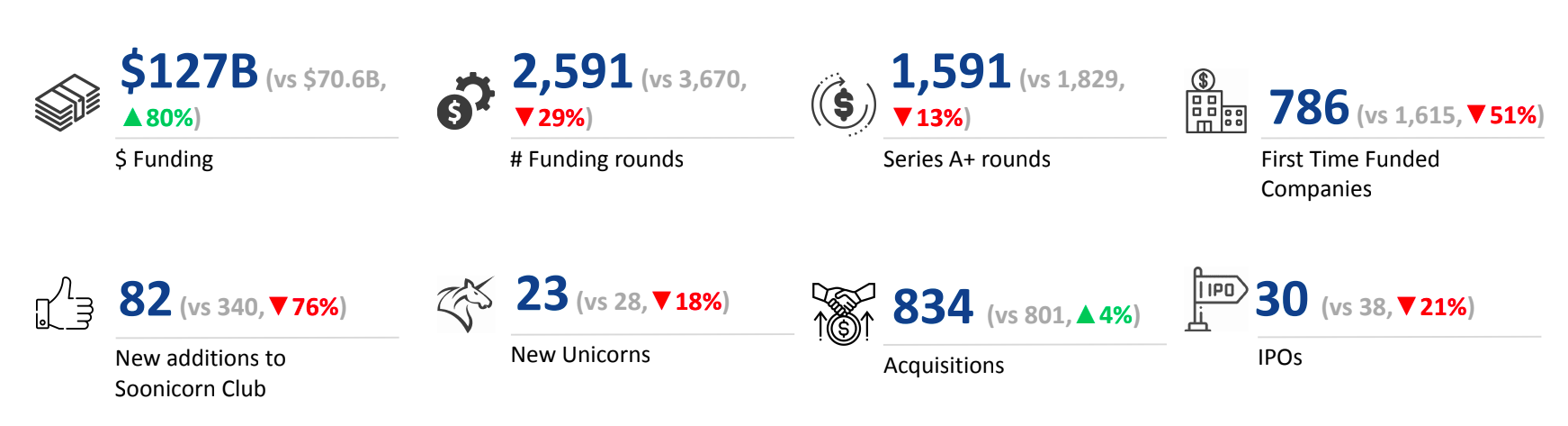

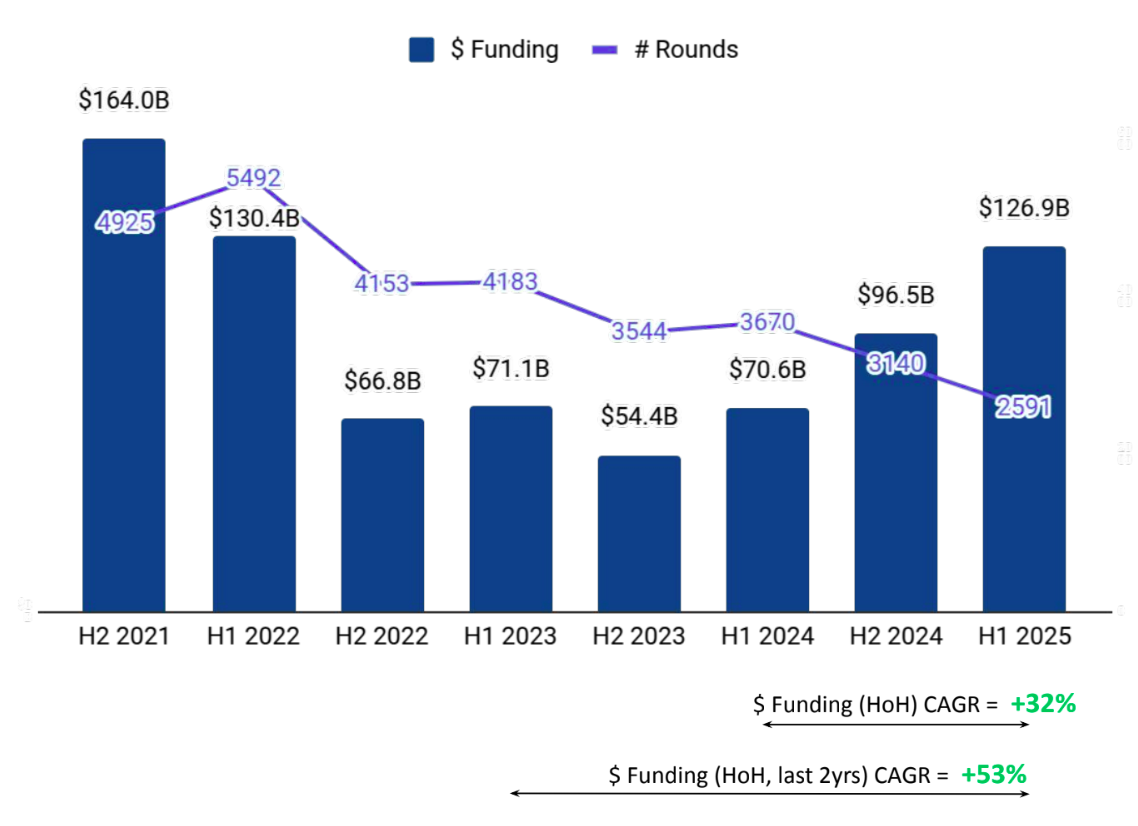

A total of $127B was raised in H1 2025 by tech companies in the United States, reflecting a significant increase of 31% compared to $96.5B raised in H2 2024 and a surge of 80% compared to $70.6B raised in H1 2024. This sharp rise positions the United States as the top-funded geography in the global tech ecosystem for this period.

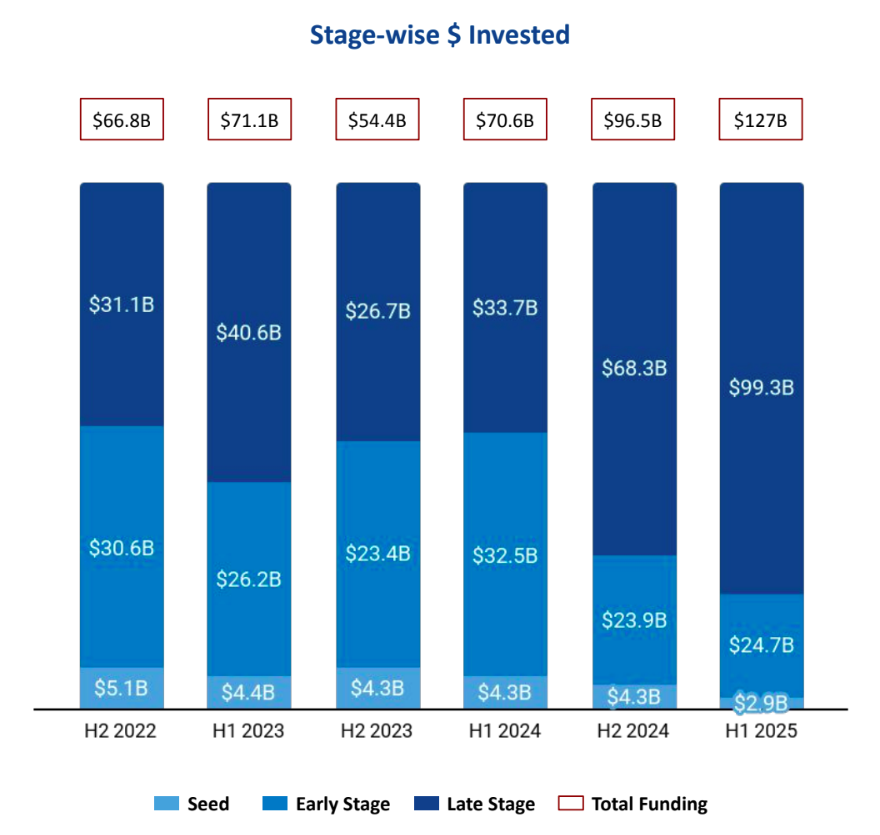

Seed-stage funding totaled $2.9B in H1 2025, marking a 32% drop from the $4.3B raised in both H2 2024 and H1 2024. Early-stage funding reached $24.7B, reflecting a 3% increase compared to $23.9B in H2 2024 but a 24% decrease from $32.5B raised in H1 2024. In contrast, Late-stage funding saw significant momentum, reaching $99.3B in H1 2025—an increase of 45% over $68.3B in H2 2024 and a 194% rise from $33.7B in H1 2024.

Enterprise Applications emerged as the top-performing sector in the United States in H1 2025, with total funding of $94.7B. This reflects a rise of 63% from $58.2B in H2 2024 and 135% from $40.3B in H1 2024. The Enterprise Infrastructure sector raised $13.1B in H1 2025, a 50% decline from $26.2B in H2 2024 but a 35% increase from $9.7B in H1 2024. FinTech also remained a key sector, raising $10.4B—down 42% from $18.0B in H2 2024 but up 22% from $8.5B in H1 2024. A major portion of the $100M+ funding rounds were concentrated in Enterprise Applications, Enterprise Infrastructure, and Aerospace, Maritime, and Defense Tech.

H1 2025 witnessed 155 funding rounds above $100M, compared to 139 such rounds in both H2 2024 and H1 2024. Major deals during this period included OpenAI raising $40B in a Series F round, Scale raising $14.3B in a Series G round, and Anthropic raising $3.5B in a Series E round. Other companies securing $100M+ rounds included World View and Anduril. Companies that went public during H1 2025 included Caris Life Sciences, Slide Insurance, Chime, and Voyager Space.There were 23 unicorns created in H1 2025, a drop of 26% and 18% compared to 31 in H2 2024 and 28 in H1 2024, respectively.

Tech companies in the United States recorded 834 acquisitions in H1 2025, showing a 3% increase from 810 acquisitions in H2 2024 and a 4% rise from 801 acquisitions in H1 2024. Among the major M&A transactions, Google acquired Wiz for $32B, making it the highest-valued acquisition in H1 2025. This was followed by the $14.6B acquisition of Intra-Cellular Therapies by Johnson & Johnson.

San Francisco-based tech firms accounted for 55% of all funding raised by US tech companies in H1 2025, making it the top-funded city by a wide margin. New York City followed at a distant second, continuing to hold a strong presence in the funding landscape.

Y Combinator, Techstars, and New Enterprise Associates were the overall top investors in the United States tech ecosystem in H1 2025. Y Combinator, General Catalyst, and Techstars were the most active seed-stage investors. Khosla Ventures, Sequoia Capital, and Lightspeed Venture Partners led in early-stage funding, while Bond Capital, SoftBank Vision Fund, and PSG dominated late-stage investments. Among venture capital firms, United States-based New Enterprise Associates led the most number of investments during the period with 13 rounds, while another United States-based fund, Bessemer Venture Partners, added 14 new companies to its portfolio. In late-stage investments, United States-based Bond Capital and United Kingdom-based SoftBank Vision Fund added 2 and 5 companies, respectively, to their portfolios.

The United States tech ecosystem maintained its global leadership in H1 2025, driven by a sharp increase in late-stage investments and a strong showing of $100M+ mega deals. Enterprise Applications, Infrastructure, and FinTech sectors led the funding momentum, while San Francisco remained the dominant city by contribution. Despite a decline in seed-stage activity and unicorn creation, overall investor activity remained strong, with major global and domestic firms actively participating across all stages.