N8

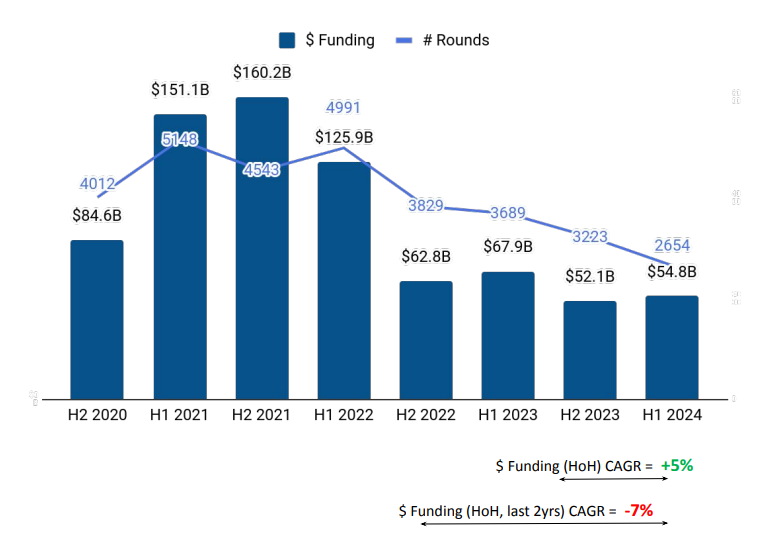

The US ranked first in H1 2024 in terms of country-wise startup funding, followed by the United Kingdom, China and India. The US Tech startup ecosystem raised a total of $54.8 billion in H1 2024, a 19% decline from the $68 billion raised in H1 2023. However, this is a 5.4% rise when compared with the $52.1 billion raised in H2 2023.

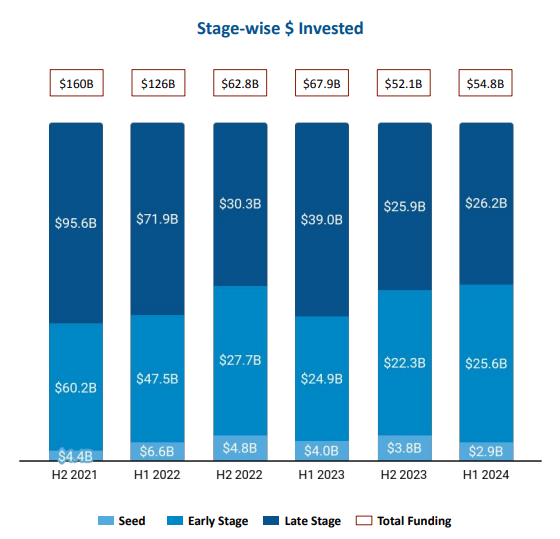

A similar pattern was observed in late-stage rounds as well. The sector attracted late-stage investments worth $26.2 billion in H1 2024, an increase of 2.7% from $25.9 billion raised in the latter half of 2023, but a plunge of 33% from $39 billion raised in H1 2023. Early-stage funding rose 15% to $25.6 billion in H1 2024 from $22.3 billion in H2 2023. This is also a 3.5% uptick from the $24.9 billion raised in H1 2023. Seed-stage funding stood at $2.9 billion in the first half of 2024, a drop of 25% from $3.8 billion raised in H2 2023 and 27% lower than the $4 billion raised in H1 2023.

The US tech startup ecosystem raised around $27 billion each in Q2 2024 and Q2 2023. This is a minor dip from the $28.6 billion raised in Q1 2024. The highest monthly funding in H1 2024 was recorded in May ($15.7 billion). In H1 2023, January 2023 witnessed the maximum funding ($18.4 billion).

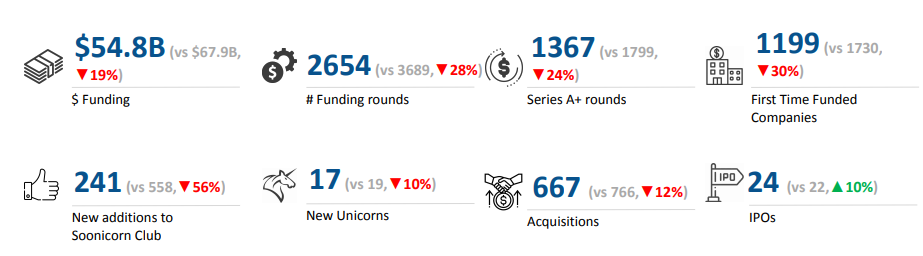

This space witnessed 667 acquisitions in the first six months of this year, as against 766 in H1 2023 and 686 in H2 2023. However, the sector witnessed 24 IPOs in the first six months of 2024, an improvement from 22 in H1 2023 and 20 in H2 2023.

Enterprise Applications, Life Sciences, and High Tech were the top-performing segments in H1 2024. Companies in the Enterprise Application segment raised $31 billion in H1 2024, 23% lower than the $40.3 billion raised in H1 2023. Funding into the High Tech space rose just 2% to $26.4 billion in H1 2024 from $25.8 billion in H1 2023. The Life Sciences secured funding worth $11.2 billion in H1 2024, 8% higher than the $10.4 billion raised in H1 2023.

&zUwinwj;

San Francisco ranked first in city-wise funding in the first half of 2024. Tech startups based in San Francisco raised $10.3 billion in H1 2024, while those based in New York City and Burlingame raised $6.2 billion and $6 billion respectively.

Y Combinator, a16z and Sequoia Capital were the overall top investors in the US Tech ecosystem in H1 2024. General Catalyst, Khosla Ventures and Sequoia Capital were the top early-stage investors in the US Tech ecosystem in H1 2024. Altimeter Capital, SoftBank Vision Fund and Geodesic Capital were the top late-stage investors in the US Tech ecosystem for H1 2024. Maven 11 and Foresight Ventures were the top seed-stage investors during the period.

Despite challenging conditions, the US startup landscape is active, with the trend hinting that there is scope for a gradual recovery.