In 2025 YTD, venture capital (VC) activity remained a powerful engine for innovation worldwide. More than 4500 VCs participated in 5000+ funding rounds across tech startups, with these rounds collectively raising around $184B in overall funding. While global VC activity continues to drive innovation, Southeast Asia’s Tech (SEA Tech) ecosystem is carving out a significant role in this landscape. During this period, over 200 VCs engaged in 110+ funding rounds (alongside other investors) in the region, adding $1.4B in total funding across 100+ unique startups. In the same period last year (9M 2024), the region saw broader engagement, with more than 400 VCs participating in 260+ rounds, involving 250+ startups that collectively raised $1.9B in total funding.

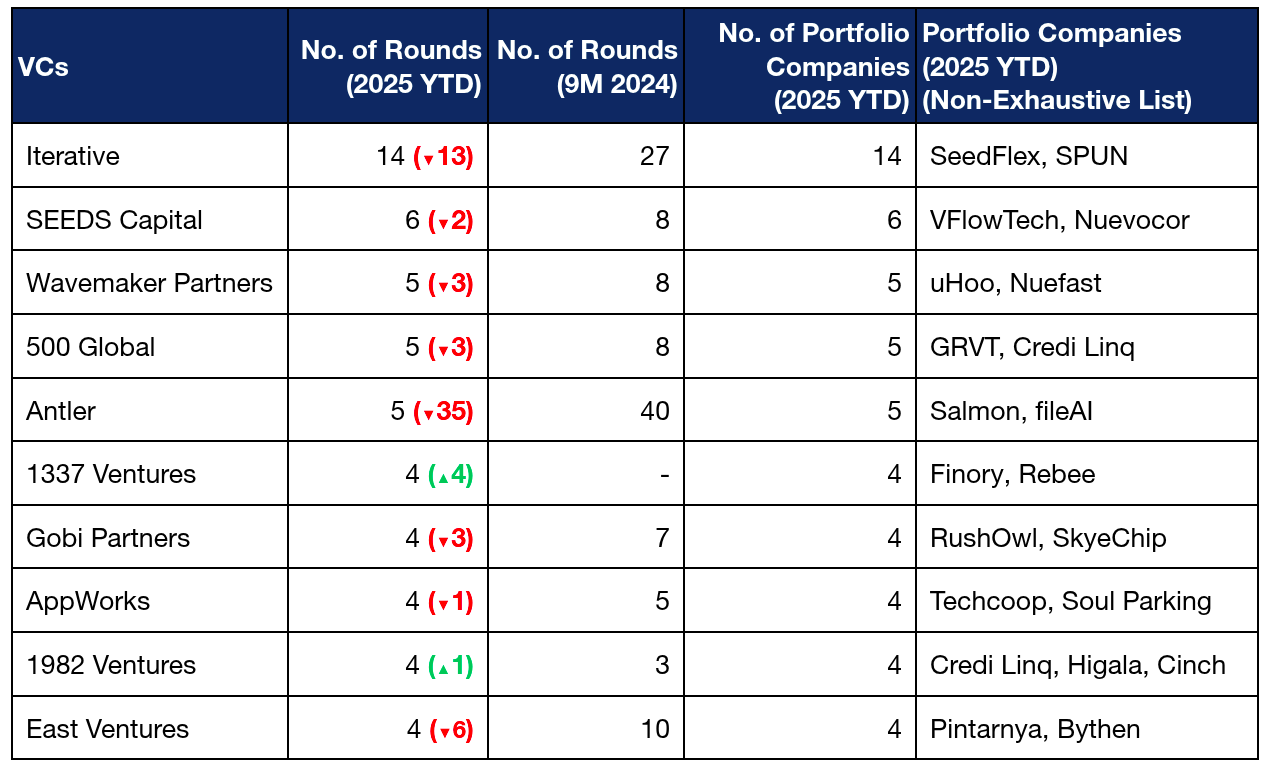

The table below lists down the top 10 most active VCs in SEA Tech, by number of funding rounds participated in 2025 YTD.

The VC landscape in 2025 reflects a clear shift in momentum among the most active ones. In 9M 2024, Antler dominated the landscape with 40 funding rounds, followed by Iterative (27) and East Ventures (10). However, in 2025 YTD, Iterative emerged as the most active VC, participating in 14 funding rounds (down from 27 in 9M 2024). SEEDS Capital followed with 6 rounds (vs. 8 in 9M 2024), while Wavemaker Partners recorded 5 rounds (vs. 8 rounds in 9M 2024). Other notable active VCs in 2025 YTD include 500 Global, Antler, and 1337 Ventures.

In 2025 YTD, SEA Tech startups have attracted active VC participation across various deal sizes. Notably, Supabase, Airwallex, and Bolttech secured rounds exceeding $100M each, while Sygnum and Syfe witnessed $50M+ rounds, reflecting VC interest across rounds.

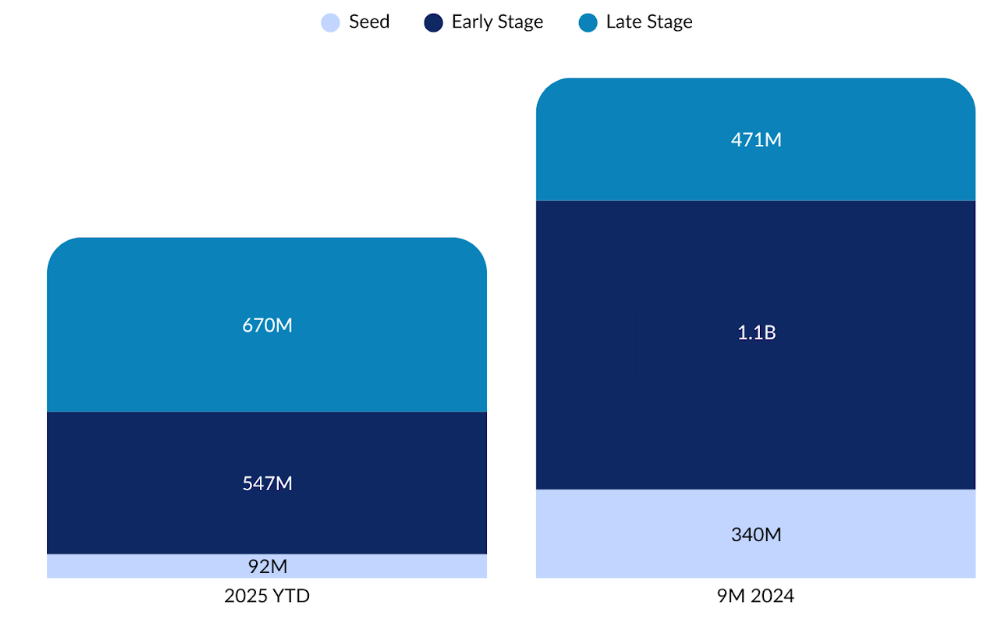

In 2025 YTD venture capital activity in SEA Tech spanned across stages, with VCs participating in 64 Seed rounds totaling $92M in cumulative funding, 48 Early Stage rounds adding to $547M, and 7 Late Stage rounds totaling $670M.

However, in the same period last year (i.e 9M 2024), VCs participated in 168 Seed rounds with startups collectively raising $340M in total funding, 89 Early Stage rounds with startups collectively raising $1.1B, and 9 Late Stage rounds with startups collectively raising $471M. The funding dip in Seed and Early Stage rounds in 2025 YTD (compared to 9M 2024) reflects a decline in overall funding, likely due to investors being cautious amid evolving economic and geopolitical conditions. Conversely, the uptick in Late Stage funding this year is largely driven by three mega-rounds exceeding $100M each, compared to one such round in 9M 2024.

FinTech, Enterprise Applications, and Enterprise Infrastructure are the top-funded sectors in SEA Tech ecosystem, where VCs participated in 2025 YTD. This marks a slight shift from 9M 2024, when Blockchain Technology ($347M) held a third spot after FinTech ($900M) and Enterprise Applications ($612M). The continued dominance of FinTech and Enterprise Applications, reflects continued investor confidence in digital finance and digital enterprise solutions.

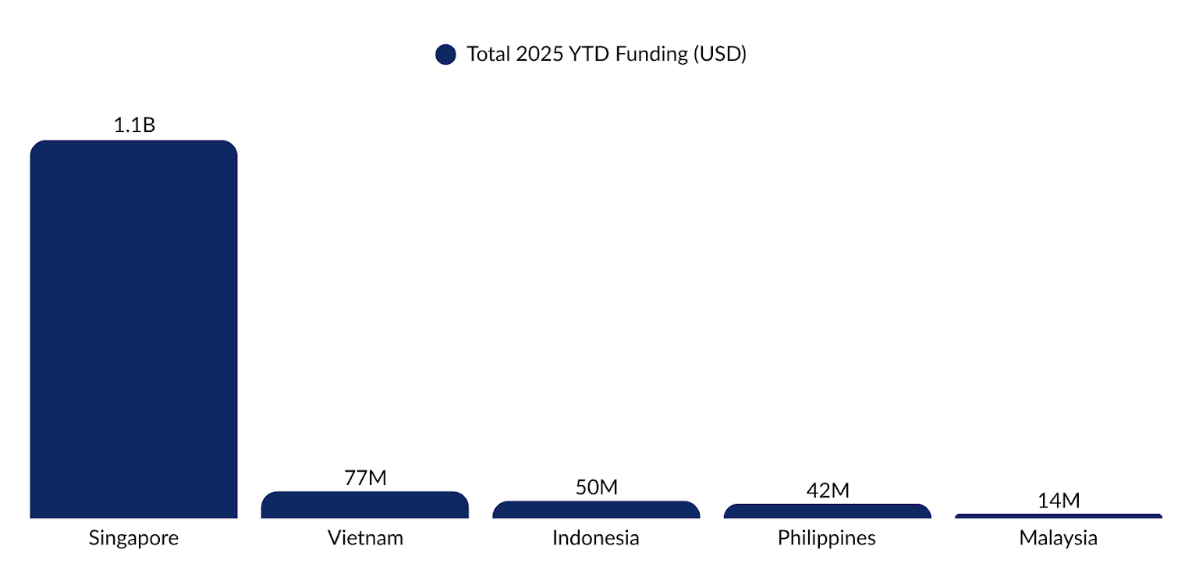

Singapore leads in total funding for 2025 YTD, securing $1.1B where VC’s participated, driven by major rounds witnessed by Supabase ($202M), Airwallex ($150M), among others. Vietnam ranks second, securing $77M in total funding in 2025 YTD, led by Techcoop ($28M) and Dat Bike ($22M), Galaxy ($10M). The other countries among the top five are Indonesia ($50M), Philippines ($42M), and Malaysia ($14M).

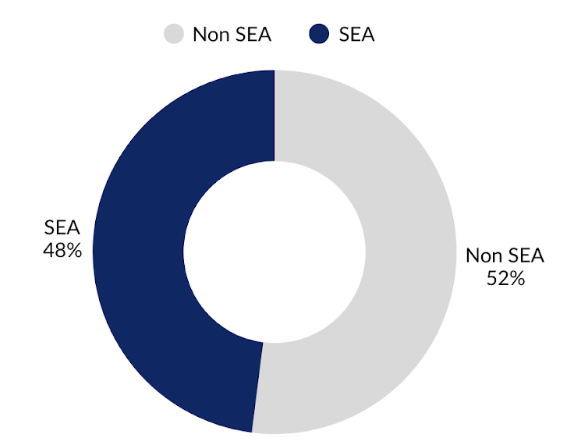

Among the 200+ VCs that have participated in the funding rounds of SEA Tech startups in 2025 YTD, over 90 are based in Southeast Asia and more than 100 are based outside the region, highlighting increasing appeal to both local and global investors.

Overall, the SEA VC landscape in 2025 YTD contracted in deal volume and early-stage funding compared to 9M 2024, yet total capital raised remained resilient at $1.4B, propelled by three mega-rounds in the Late Stage. Iterative emerged as the most active VC, while Singapore maintained its dominance in securing the majority of funding, primarily in the consistently strong FinTech and Enterprise Applications sectors, attracting balanced participation from both local and international investors.