Tracxn, a leading global SaaS-based market intelligence platform, has released its Vietnam Tech Annual Report 2024. Based on Tracxn’s extensive database, the report provides insights into the Vietnamese Tech space.

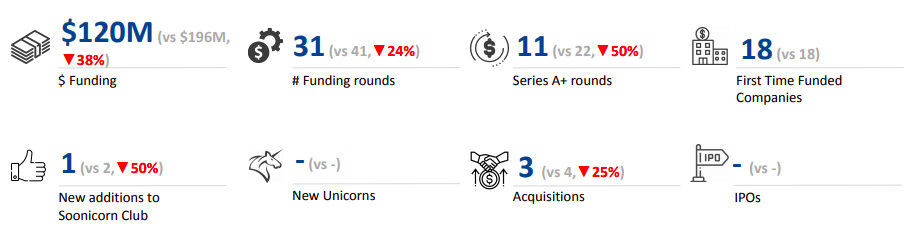

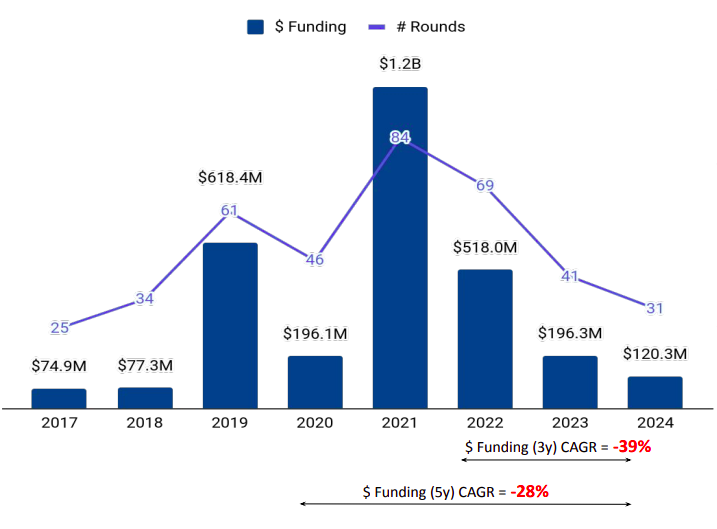

In 2024, Vietnamese tech startups raised $120 million in funding, representing a 38% decline from the $196 million secured in 2023 and a sharp 77% drop compared to the $518 million raised in 2022.

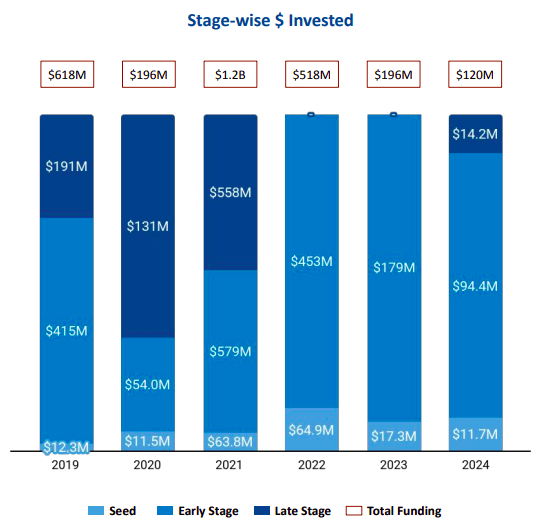

Image: Y-o-Y Stage-wise Funding Trends (Note: Seed includes Seed, Angel rounds. Early Stage includes Series A,B rounds. Late Stage includes Series C+, PE, Pre-IPO rounds)

Stage-wise Investment Trends

● Late-Stage Funding: Late-stage investments saw funding of $14.2 million in 2024, resuming activity after 2021.

● Seed-Stage Funding: Seed-stage investments dropped by 32.37%, falling to $11.7 million in 2024 from $17.3 million in 2023.

● Early-Stage Funding: Early-stage funding experienced a 47.26% decline, totaling $94.4 million in 2024, down from $179 million in 2023.

Sectoral Performance

Top-performing sectors in 2024 included Gig Economy, Auto Tech, and Transportation and Logistics Tech: N8

● Gig Economy: Funding surged nearly 38 times compared to 2023 and grew almost fivefold compared to 2022.

● Auto Tech: Funding grew more than 10 times in 2024 compared to 2023 and increased by 116% compared to 2022.

● Transportation and Logistics Tech: Funding rose over 10 times compared to 2023 and grew by 58% compared to 2022.

Top cities leading the landscape

● Ho Chi Minh City-based tech firms accounted for 56.59% of all funding raised by Vietnamese tech companies.

● Hanoi followed behind, contributing 26.25% of the total funding.

Leading Investors

CyberAgent Capital, 500 Global and Genesia Ventures emerged as the top investors in the Vietnamese tech ecosystem, actively supporting startups across various stages.

Mergers & Acquisitions

The Vietnamese tech ecosystem recorded 3 acquisitions in 2024, down from 4 in 2023. Notable deals include:

● RHB Vietnam Securities’s acquisition by Public Bank for $15.2M, VinBrain’s acquisition by NVIDIA and Home Credit Vietnam’s acquisition by SCBX are the 3 acquisitions that occurred in 2024.

This data underscores the evolving dynamics of the Vietnamese tech ecosystem, reflecting botUwinh growth opportunities and challenges across different funding stages, sectors, and regions.