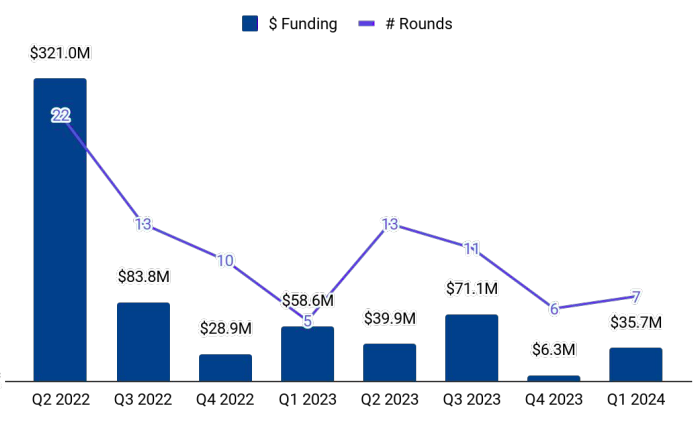

Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Quarterly Report: Vietnam Tech Q1 2024. The report, based on Tracxn’s extensive database, provides insights into the Vietnam Tech space.

Vietnam ranks third in terms of funding raised by Southeast Asian (SEA) countries in Q1 2024 to date, after Singapore and Indonesia. This is a positive change from Q4 2023, when Vietnam had ranked fourth among the SEA countries based on tech startup funding.

Sports

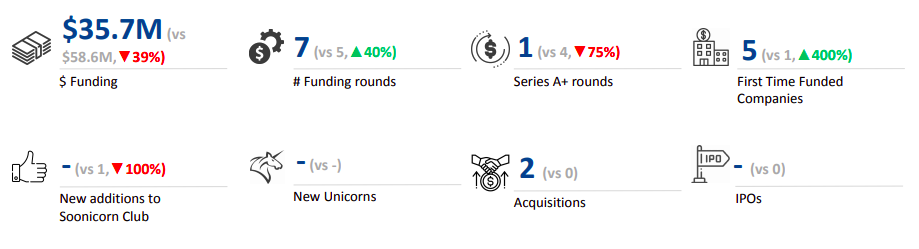

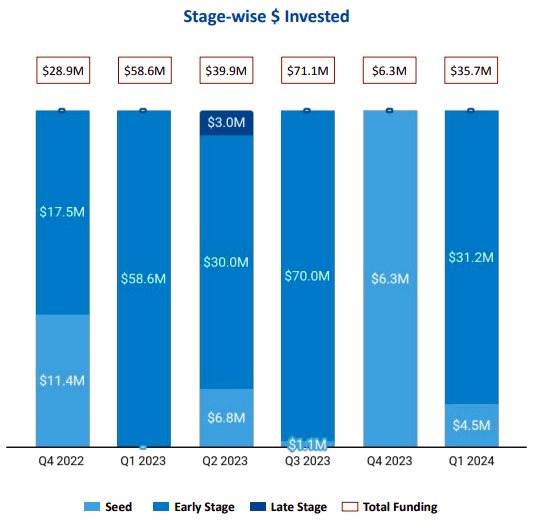

Early-stage investments in Q1 2024 to date stood at $31.2 million, 47% lower than the $58.6 million raised in the same period in Q1 2023. There were no early-stage rounds recorded in Q4 2023. Companies in this space secured seed-stage funding worth $4.5 million in Q1 2024 to date, 29% lower than the $6.3 million raised in the same period in Q4 2023. No seed-stage investments were observed in Q1 2023, and no late-stage funding has been recorded for three consecutive quarters in a row.

Be Group, an app-based aggregator that offers booking services for motorbikes, cars, air tickets, passenger cars, fast delivery, etc., raised $31.2 million in a Series B round, making it the highest funded round in this space in Q1 2024 to date.

Auto Tech, EdTech, and Enterprise Applications were the top-performing segments in the overall Vietnam Tech sector in Q1 2024 to date. Companies in the AutoTech and EdTech spaces had not secured any funding in Q4 2023 but raised $31.2 million and $2.5 million respectively in Q1 2024 to date.

No new unicorns have emerged in this ecosystem in 2024 so far, similar to Q1 2023. There was hardly any activity in terms of exits, with only two acquisitions and no IPOs.

In terms of city-wise funding, tech startups based in Ho Chi Minh City raised $33.2 million in Q4 2024, while those headquartered in Binh Thanh raised $2.5 million.

CyberAgent Capital, Nextrans and Vietnam Silicon Valley are the overall all-time most active investors in this space to date. Northstar Ventures, Monk's Hill Ventures, and R2 Venture Partners were the top seed-stage investors in this space in Q1 2024.

Vietnam has established itself as an emerging startup hub in Southeast Asia, and there is potential for this ecosystem to grow in the coming years.