Vietnam’s technology startup ecosystem has crossed a major milestone, with over 5,500 startups, of which more than 4,100 remain active, and a funding inflow of $3.2 billion, according to Tracxn’s Vietnam Tech Startup Pulse: An All-Time View. The report underscores the country’s transformation into one of Southeast Asia’s most dynamic startup hubs, marked by the rise of six unicorns, nine mega funding rounds, and an increasingly diverse portfolio of funded ventures.

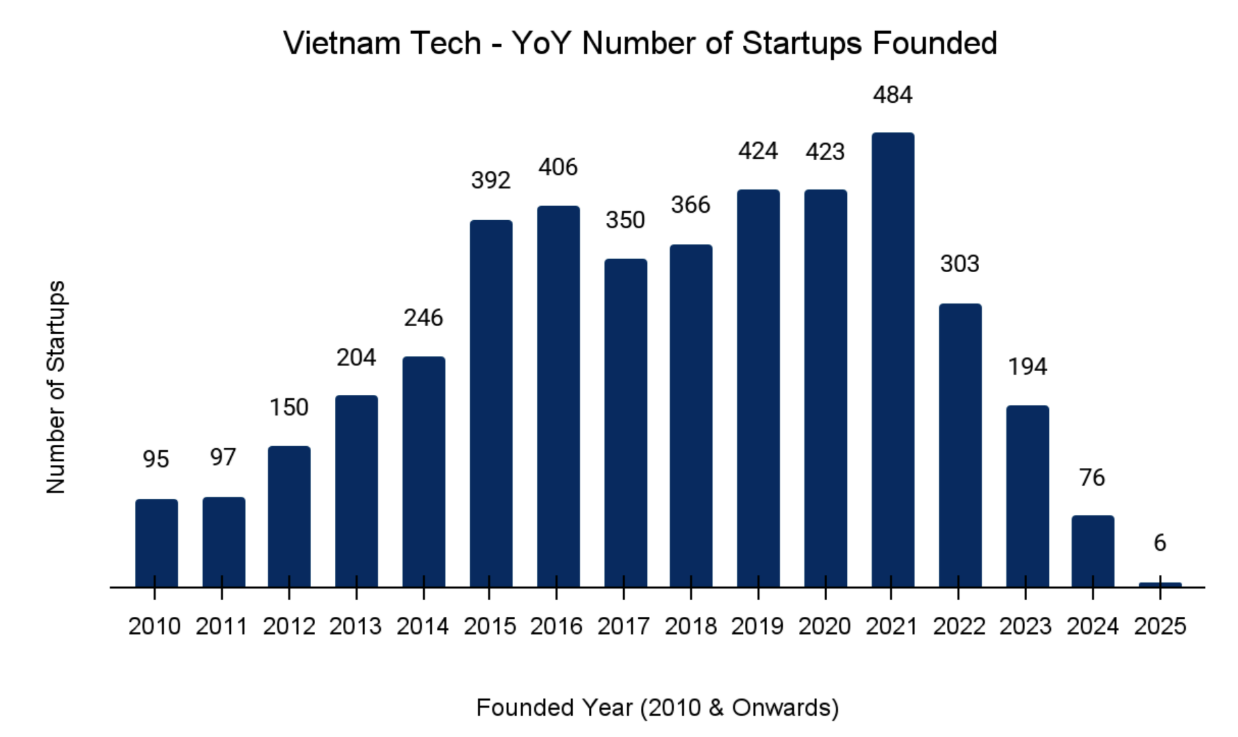

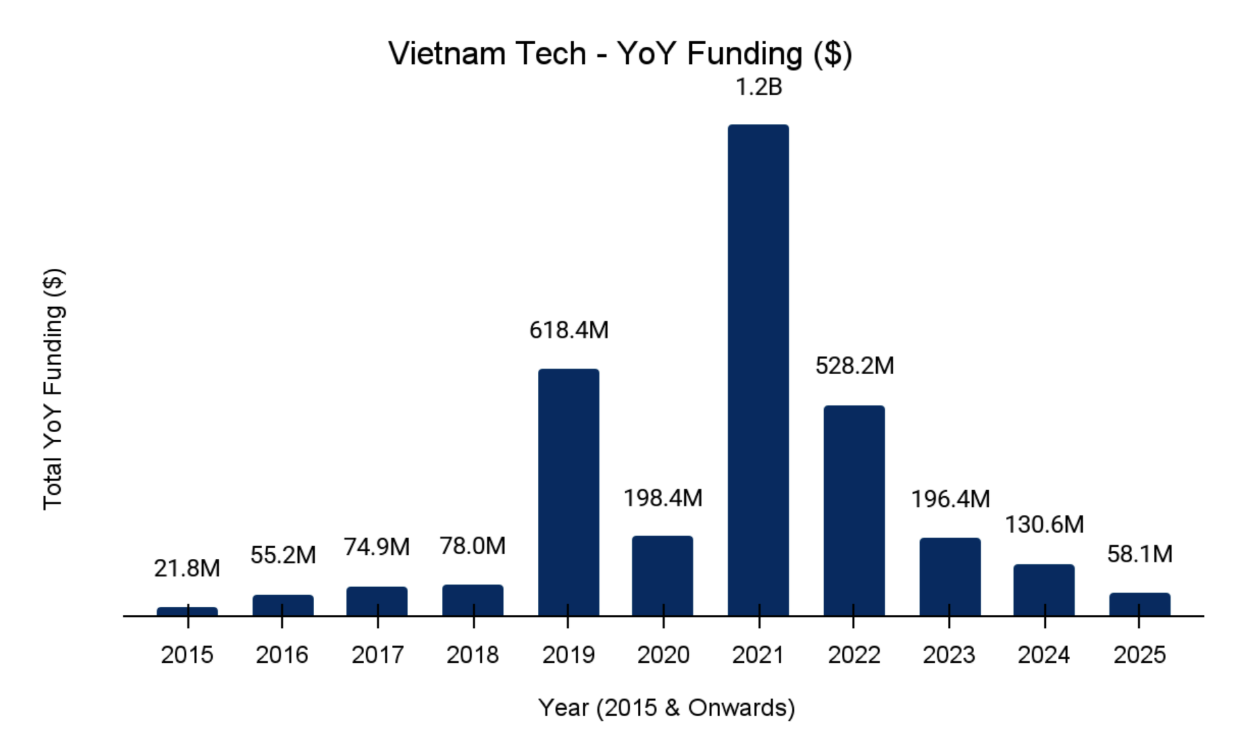

The ecosystem’s growth has been particularly striking over the past decade, with more than 60% of all startups founded between 2015 and 2025. Funding momentum has accelerated during this period, with $2.3 billion—nearly three-quarters of all-time funding—secured in just the last five years. The year 2021 proved to be the watershed moment, when Vietnam recorded $1.2 billion in startup funding, led by landmark rounds from Tiki, VNLIFE, and MoMo.

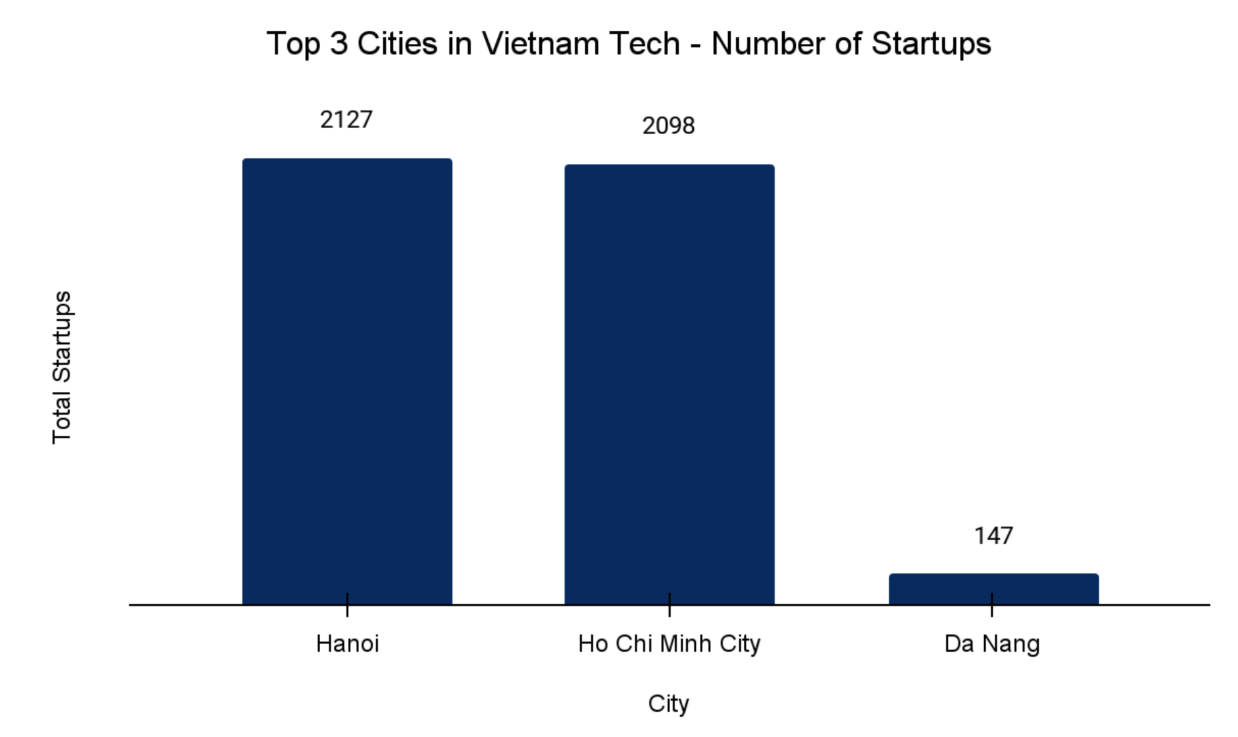

The country’s innovation landscape remains highly concentrated in its two largest cities, with Hanoi hosting 2,127 startups and Ho Chi Minh City following closely with 2,098. Together, they dominate the startup map of Vietnam, while smaller hubs such as Da Nang and Can Tho represent emerging centers of entrepreneurial activity. Ho Chi Minh City stands out as the nation’s top-funded city, attracting $1.8 billion in funding, powered by major fundraisers like Tiki and MoMo. Hanoi has also established itself as a key hub, securing nearly $1 billion, with VNLIFE alone accounting for more than half of that amount.

Venture capital has played a defining role in this surge, accounting for over 90% of all year-on-year funding from 2020 to 2025 YTD. More than 290 venture firms have invested in Vietnamese startups so far, with CyberAgent Capital leading at 24 rounds, followed by Genesia Ventures and Do Ventures. Investor confidence has been further underscored by nine mega funding rounds exceeding $100 million, three of which were raised by MoMo, while Tiki, Sky Mavis, and VNLIFE also closed multiple late-stage rounds.

N8Vietnam has now produced six unicorns: Tiki, MoMo, Sky Mavis, VNPAY, VNLIFE, and VNG. Each has contributed uniquely to shaping the country’s digital economy. MoMo has emerged as the leading digital wallet, expanding into lending, insurance, and investments, while Sky Mavis gained global recognition through its blockchain-based gaming success, Axie Infinity. Tiki has strengthened e-commerce logistics, VNG continues to dominate the gaming sector, and VNPAY and VNLIFE have accelerated Vietnam’s shift toward cashless payments. Together, these companies represent the diversity, innovation, and scalability that define the Vietnamese startup story.

Beyond its unicorns, the ecosystem has also seen the rise of several high-growth companies that have collectively raised over $400 million. Startups such as Sendo, OnPoint, Telio, Thuocsi, and Nhi Dong 315 are expanding aggressively in e-commerce, B2B distribution, healthtech, and omni-channel enablement. Their growth reflects both the increasing maturity of the market and the willingness of investors to back ventures beyond the headline-making unicorns.

Vietnam’s ecosystem has also matured in terms of exits, with 76 recorded to date, including 52 acquisitions and 24 IPOs. Landmark deals, such as Central Group’s $1.05 billion joint takeover of Big C & Nguyen Kim Group and Sea Limited’s $64 million acquisition of Foody, demonstrate how global and regional players are consolidating Vietnam’s digital and consumer markets. More recently, IPOs from BeLive Technology and TCBS in 2025 signalled growing investor appetite for Vietnam’s next wave of scale-ups, particularly in fintech and digital services.

Commenting on the findings, Neha Singh, Co-founder of Tracxn, said: “Vietnam’s tech startup ecosystem has matured rapidly, driven by a mix of government support, urban innovation clusters, and a strong influx of venture capital. The emergence of multiple unicorns and billion-dollar funding years signals both local and global investor confidence. As the market continues to diversify across fintech, e-commerce, gaming, and healthcare, Vietnam is poised to be one of Southeast Asia’s most influential startup hubs.”

The foundation for this growth has been built over a decade of supportive policies and ecosystem initiatives. Programs such as Vietnam Silicon Valley (2013), the National Technology Innovation Fund (2015), and Project 844, which incentivised early-stage ventures, have played a central role. The landmark 2017 Law on Support for Small and Medium Enterprises further legitimized startups as legal entities, creating the framework for today’s thriving ecosystem.

As Vietnam transitions from a surge of entrepreneurial creation to a phase of sustained scaling, the ecosystem’s trajectory highlights both the opportunities and the depth of innovation taking root in the country. With a strong base of startups, substantial late-stage funding, and an increasing number of successful exits, Vietnam has firmly established itself as a rising force in Southeast Asia’s technology landscape.