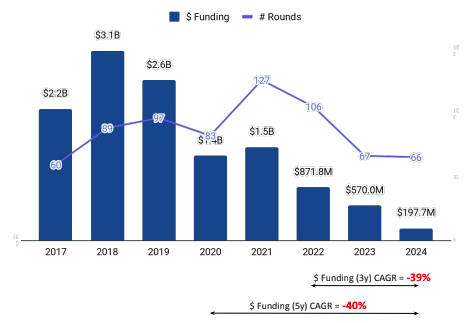

The Southeast Asia (SEA) startup landscape has more than 35,000 active tech companies, with more than 2,000 having female founders. Despite early momentum, funding for women-led tech startups in the region has seen a steady decline since reaching a peak of $3.1 billion in 2018. Several factors have contributed to this downturn, including global economic challenges, geopolitical tensions, and a general funding slowdown.

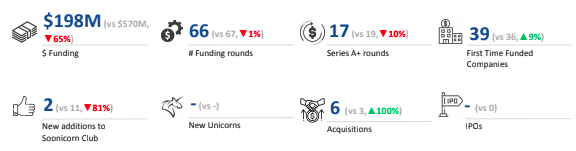

In 2024, women-led tech startups in SEA secured $198 million in total funding, accounting for 6% of the region’s overall $3.09 billion tech startup funding. This marks a 65% decline from the $570 million raised by women-led tech startups in 2023 and a 77% drop from the $871.8 million raised in 2022.

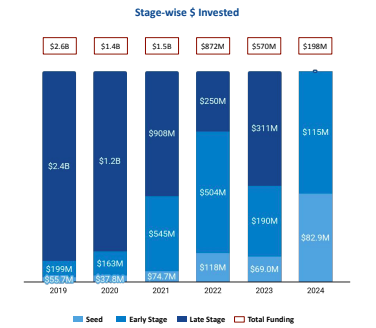

Early-stage funding in 2024 amounted to $115 million, representing a 39% decline from $190 million in 2023 and a 77% plunge from $504 million in 2022. Seed-stage funding in 2024 increased to $82.9 million, a 20% rise from $69 million in 2023, but a 30% fall from $118 million in 2022. No late-stage funding was recorded in 2024 compared to $311 million in 2023, and $250 million in 2022.

None of the deals observed in 2024 crossed the $100 million mark. The majority of the investments in 2024 were witnessed in Q1 ($117 million), contributing to more than 59% of the total, while Q3 saw the least funding ($31.1 million).

Blockchain Technology companies led the funding landscape with $133 million, a 391% increase from $23 million in 2023 but a 36% decline from $177 million in 2022. The FinTech sector ranked second, raising $91 million in 2024, a 79% and 86% decrease from $427 million in 2023 and $665 million in 2022, respectively. The Enterprise Applications segment raised $60.6 million, a 74% drop from $233 million in 2023 and a 90% decline from $614 million in 2022.

Exit activity remained weak, a trend observed in the wider startup ecosystem as well. Six tech startups led by women were acquired in 2024, doubling from three in 2023 but reflecting a significant drop from 11 in 2022. Aptar Digital Health’s acquisition of Healint was one of the notable deals. No IPOs were recorded in 2024, continuing the trend from 2023.

Singapore stood first in terms of city-wise funding in 2024, with women-led startups in the country securing $154 million in funding. This was followed by Jakarta and Hanoi, which observed funding worth $33 million and $20 million, respectively.

Antler, Wavemaker Impact, and 500 Global took the lead in seed-stage investments in 2024, while Vertex Ventures, SEEDS Capital, and SIG Venture Capital were the most active early-stage investors.

Government support is also playing a crucial role in helping women-led startups drive innovation. The ASEAN Coordinating Committee on Micro, Small, and Medium Enterprises (ACCMSME) and ESCAP developed a Policy Toolkit to integrate women entrepreneurs into national MSME policies.

We-Fi and ADB back the WAVES program, aimed at improving financial access and strengthening business conditions for women-led SMEs. SG Women in Tech (SGWIT) promotes gender diversity by encouraging recruitment, retention, and career advancement programs for women in technology.

Ongoing initiatives and increasing support from investors and institutions continue to push for better opportunities for women-led startups in the SEA tech ecosystem.

* Meaning of Women-led Startups: Startups having at least one woman as founder / co-founder